“Show me the incentive and I will show you the outcome” – Charlie Munger

The past decade has seen many simple established investment phenomena been questioned. From negative interest rates to negative prices for crude, what was considered to be once a millennium events (six sigma events) have suddenly popped around the world all in a decade. We find that the investment rationale and logic have been stretched to the highest degree in stock valuations and yet we find under performance in other asset classes(commodities) that go past many decades. The current uncertainty in the investment world is probably the highest one has seen in his life time. Never before were the assumptions been questioned and making money so difficult. The one question on most investors and the general public is: where do I deploy my surplus cash?

If one goes by the government figures, inflation has been benign. Yet investors don’t really believe the same. They have seen their expenses balloon and savings rate reduce. Not to mention the underperformance in most major asset classes has reduced their other income. Business growth through organic means is difficult to come by both for most established corporates, industrial capacity utilization is below 70% and small businesses and salaried employees have seen their increments diminish over a period of time. In such case, investors depend on markets and fixed income sources to meet their requirement of retirement planning and investment. But markets performance has been volatile and can be said to be mixed at the best creating doubts in the mind of investors whether they can be entrusted with their life savings not to mention the precarious position of the banking system and the failure of regulatory bodies in stopping the scams. The confidence has been maintained through frequent bail outs and interventions increasing moral hazard.

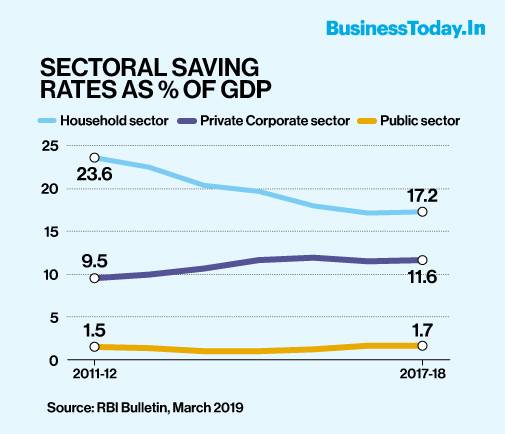

Source: Business Today, https://www.businesstoday.in/current/economy-politics/decoding-slowdown-dip-in-household-savings-investment-an-indicator-of-structural-economic-slowdown/story/380394.html

Source: RBI Bulletin April 2020

What has created this problem? How is it that a nation that was growing at 7% per annum with increasing educated and young working population has suddenly found itself devoid of investing avenues? To understand this, one also needs to look at global trends. Most analysts feel that India is facing problems created by itself. While this is true to most extent and reforms are need of the day, external factors are also exacerbating the problem. From 1990s, when India unleashed animal spirits in the economy by breaking the license raj till 2008, global economy was undergoing expansion. Many educated Indians settled abroad and remitted their earnings creating stable flow of foreign reserves which were the reason why we had the crisis in the first place. Stock markets boomed, credit flew, IT boomed and mushroomed a lot of other industries with it. Real estate started gaining traction. At the same time, agriculture productivity improved and could feed the growing population. Consumption boomed as income jumped and prospective job opportunities increased too. Infrastructure and investment cycle saw an uptick.

Source: Tradingeconomics.com, RBI Data

The present Foreign reserve in India is $479.57 Billion.

In the above chart it is visible that the unprecedented increase in the forex since 2000 was the real effect of economic development.

Then came the global financial crisis in 2008. Post 2008 crisis, there was a dip in the reserves and it remained below 300 billion till 2014.

India was expected to come out of global financial crisis unhurt which it did thanks to the Banking system which remained unhurt due to real income in Indian economy and intrinsic value of assets held as collateral with banks. This helped India to come out of the crisis in a ferocious way. But at the same time, the world was a different place. Investments and capital expenditure slowed down. While financial assets rose in value, commodities and other assets got hit. Instead of growing sales, earnings were increased through tax classifications and non-GAAP measures of accounting with share buybacks aiding EPS growth. Executives had no need to drive the top line growth when the only performance indicator, the stock price, could be manipulated through share buybacks and increasing debt. Markets gave insane valuations to “network effect” based businesses neglecting cash flows and increasing debt. The cornerstone has been the support of the central banks who have created the perception of killing risk at every incidence of panic in the market. We have already discussed the above issues in previous articles and hence we request our readers to go through them for further details.

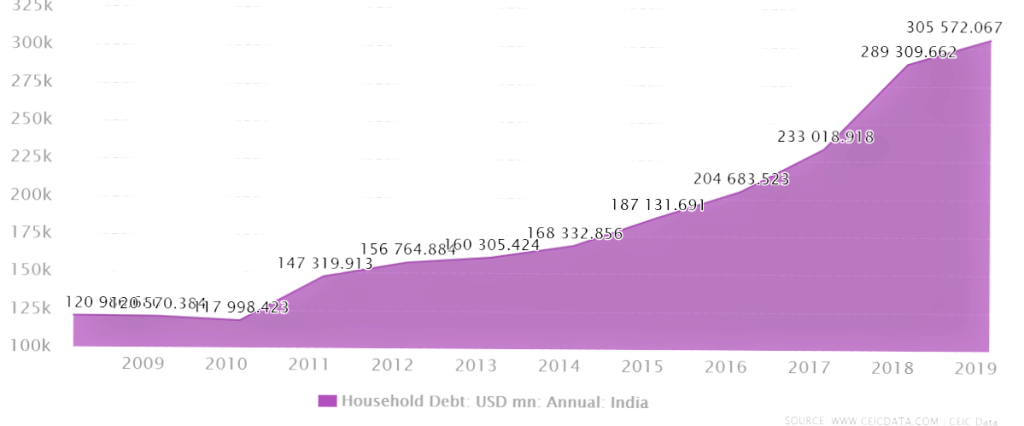

Post 2008, India has seen growth through consumption and through financialization of the economy. Increased consumption has come at the cost of reduction in savings and increased debt. While general growth in consumption is welcome, it has reduced the capacity of households to absorb shocks.

Source: ceicdata.com

Those shocks have come in multiple forms: Demonization and then GST. While these measures have formalised the economy, the impact that the shocks generated and the healing time provided were inadequate. An economy ship is not easy to shift especially when millions of people are dependent on informal economy.

Incentives of the Various Participants

The government has been trying to increase tax to GDP ratio. India has had poor tax to GDP ratio compared to many developing countries. To increase the same, it was decided to cut down sources of black money. As a result, demonetization made cash hoarding difficult, import duty on gold made it expensive and reduced demand, interest rates have been reducing for quite some time and many find it inadequate to generate returns above inflation. Therefore, the only choice was to take shelter in equity and debt markets. Here too, most investors didn’t have much choice except through mutual funds as most investors lacked adequate understanding of the markets and dedicated effort and time for identifying individual stocks and risks (AMFI too came with mutual fund campaign). This made taxing easy. LTCG came with Grandfathering date in and now all gains could be taxed too. This was the important step to ensure that gains in the market could be taxed.

Source: Financial Times, 2016-17 Data IMF, National Govt

Source: Indpaedia.com

Source: World Bank

From the time LTCG came into existence, dividend distribution tax has been abolished and now dividend is chargeable in the hands of the shareholders. Further, super rich people are now been penalised with surcharge and cess which makes income taxable to the extent of 42%. The dividend is also taxable as normal income under income from other sources which was earlier exempt in the hands of recipient and company declaring dividend needs to pay 20.56% as Tax. These are ways and means to increase the tax. But there are always options and corporates will find a way to skip those too like change of citizenship to obtain benefit of lower tax on dividend, etc. The unfortunate victim will be the shareholder who will increasingly see corporates skip dividends as they don’t make any sense. This is a case of how government incentives are impacting shareholder returns. Every year during the budget we find people and analyst clamouring for LTCG tax removal, but without understanding the incentives for the government they are merely barking at the wrong tree.

Moreover, the regulatory oversight in matters of fraud have been found wanting. Companies have been found giving inadequate information and siphoning funds. While the old ways of promoters taking their shareholders for a ride are gone, new methods have been found. Many auditors have been found to have not done proper due diligence. Tax authorities have unearthed scams of GST avoidance by many corporates. Some have even fled the country and the administration has been forced to bring them back. Many are still serving time in judicial custody. The incentives for the promoters haven’t been to increase shareholders wealth as most capital market advocates tend to think. Shareholder’s wealth has been eroding for quite some time (in the broader market).

Similarly, the role of the RBI is to maintain stability and confidence in the financial system and maintain price stability. Since 2015, RBI has been at the forefront of breaking the bubble and initiating a soft landing for the financial firms stuck in the non performing assets trap. It was only due to the actions of the RBI that the bubble in the NBFCs burst and steps were taken to quickly recapitalize the banks. But it was found to have done little to seek credible information. Many rating agencies were caught sleeping and banks were found hiding non-performing assets in spite of standard disclosure norms. The ILFS and DHFL scam have shown that when it comes to understanding the banking and financial industry much of the data is kept obscured. It seems the regulatory mechanisms have failed the investors who had directly or indirectly invested in such firms. Yet even after these episodes have taken place, we still find scheduled banks failing and need bailouts time and again. The virus has given another opportunity for the banking and financial firms to extend and pretend. Even before the virus, banks were seeking moratorium for loans to builders and MSME segments. Even the Government in its relief package has directed banks to not to recognise NPAs of MSME till March 2020 which keeps the real picture of banks balance sheets from being unveiled. Unfortunately, these non-performing assets will keep on dragging the weak banking system, keep asset prices inflated and never let the markets clear off the inventory and hence increase the cost of borrowing. Therefore, credit will be difficult to access as banks remain reluctant to lend to people and industry with weak credit ratings and thereby hamper growth. Thus, we find that while the incentive of the RBI is to stabilize the system, the incentives of the banks and the steps taken by the RBI seem to have impacted the economic growth.

Investor Psychology

The average time an investor has stayed in the financial markets is less than a decade. Most investors have never seen a bear market in their lifetime. Few have a memory of the bear market in 2008 Global Financial crisis as the resultant rally has left the pain of the bear market in the drain. Investors have been given a false sense of complacency and hope that in case the markets tank, central banks will always come and save the day. Hence, the general consensus is to follow the success of a few investors or the momentum and make gains. The spread of the social media has further increased investors access to information. However, it has also created the scope for herd mentality to takeover. There have been episodes in the past where investors have been lured by particular group of stocks and finding the next multi baggers had become a fantasy game. Those who have been able to stay away have fallen into the trap of attractive investment ideas from mutual funds and other institutionalised investment participants. Most have been delivering subpar returns for past few years as compared to their previous five-year returns. Some may blame the market yet it is also known that mutual funds are flush with funds and have been supporting the markets while foreign portfolio investors have been withdrawing the money. One therefore wonders as to what is it that makes the fund managers so bullish.

FII figures (Cash Data) Source: Edelweiss

DII cash Data Source: Edelweiss

Source: Economic Times, BCCL

To answer that one has to look at the incentives of the fund managers. Most fund managers are paid management fees which is a certain percentage of their asset under management (AUM). Thus, there is no need to perform as long as one can increase their AUM. The fund can keep growing while taking increased risk in assets which are perceived to be liquid but not stress tested for liquidity risk. Hence, we are now finding mutual funds writing down NAVs due to actual realization of those risks. Unfortunately, investors are at risk both from the speculators and institutionalised funds.

Banks & Financial Intermediaries

Much of the growth in the past decade has been due to consumption and credit expansion has been at the forefront. At the start of the decade, NBFC led the growth in real estate and moved into consumer finance.

Source: Ceicdata.com

Public sector banks had their hands full in lending to corporates and retail. Capital investments made after 2010 had started souring by 2014. Many corporate loans went bust. A few Non-Banking Financial institutions failed as liquidity dried and rates went up. At present, even good franchises are facing problems of Asset Liability mismatch. Public sector banks had to be bailed out and system got frozen. At the height of it, the total Non-Performing assets were 10% of the total loans. This made banks conservative and started raising lending standards. Credit access became difficult. Economy suffered due to lack of easy access to credit and consumption suffered. The economy started performing at less than optimum levels and profits eroded making interest payments difficult. To resolve the economic problem, interest rates have been cut consistently. Interest rates on savings have dipped below 4% to even 3% for savings accounts and below 6.5% for fixed deposits. Inflation currently is above 5% which means that investors are not comfortable to put money in the banks for fixed deposits as interest earned after tax is more or less equal to the inflation. This makes it difficult for investors to earn a fixed income and safe haven investments are decreasing thereby reducing the cushion in case of losses in other investment assets. Most of the globe is facing a similar issue. Corporate fixed deposits are also now been considered risky due to default risk rising. The only place to earn decent returns then is the small savings schemes like PPF whose interest is tax free along with availability of exemption in 80C of Income Tax and SCSS(Senior citizen saving Schemes exempt u/s 80C) which also offer safety of the government.

Source: Shiller,2020 ; Tradingeconomics.com, Benchmark Repo Rate, RBI

When financial assets fail, one may look at real assets like real estate, gold and other commodities. However, the performance has been mixed at best. Real estate performed at the start of the decade but prices have gone too high in most tier – I cities and inventory is increasing in spite of few projects been launched. RERA has tightened the norms and hence it is now difficult if not impossible for misuse of project funds that kept the boom running. The failure of few projects in the NCR region due to outside borrowings at whooping interest rate along with costly NBFC Loans and several other parts of the country have increased the desire for ready possession flats and apartments. Commercial real estate did well but in wake of the virus such trend can’t be expected to continue. Yields on rents from real estate have been declining (due to increased prices) and interest costs are higher as compared to the yields therefore making less sense as an investment alternative. Besides, prices have remained stable reducing expectations of increased capital appreciation in most cities. Therefore, real estate is proving to be a risky investment alternative with potential to inflict long term loss on the invested capital.

This leaves out gold and investible commodities. Gold has only recently started performing. Between 2013-18, its returns have been negative and there has been an increased negative perception on gold as it doesn’t yield anything. The government has been running a sovereign bond scheme which has been providing a yield on gold bonds & Tax free returns on redemption i.e. No capital Gains Tax but it is really a financial vehicle rather an investment in gold. No gold ever gets traded or changes hands. That apart, returns have been increasing and bonds can be traded before maturity therefore reducing maturity risk and improves liquidity. But the performance is still dependent on the gold prices which haven’t been impressive in the last seven years (compared to fixed income). Commodities have been in a bear market since many years and hence not attracting investments too.

Source: World Gold Council, goldprice.org

The point that we have been trying to make is that there are times when it is easy to make risk free returns, there are times when it is easy to make returns with optimum degree of risk and there are times when a high degree of risk exists in the market. Currently we are in the latter stage and hence it makes sense to tone down returns expectations while trying to deal with the risks involved. These systemic risks will have to be dealt with care as investors can lose their decades of corpus in few months. Hence while some asset classes will make sense from the point of view of returns the inherent nature of the risk involved will have to be studied with greater sensitivity. There is little margin of safety in equity class as they are overvalued in most aspects. There will be a few winners but the broader markets will underperform. Markets have narrow leadership.

Portfolio investing is like making a building. Imagine you are sanctioned to create a building of 15 floors with total of 60 flats. However out of greed and neglect, you plan to add 5 more floors and construct 20 additional flats. You don’t take approvals and flout the norms. You might have a 20 floor building constructed. But the same is untested for external shocks. A single earthquake can jeopardise your years of work and collapse the entire structure. And it will all be because of the extra 33% that you intended to make leading to the destruction of the 100% capital. Systemic risks are such earthquakes. They might not come, but you better be prepared to handle them. While making a ship, planners have to take into consideration various storms and typhoons that the ship can meet. Planning for 5% probability events has become as important as planning for the 95%. You may not encounter them, but the potential loss in case of event happening is guaranteed and will take an entire life to rebuild. Such events today are called black swan events. But they are basically about managing risks. And with the incentives of players in the system far different than those of the investors, they are better off managing these risks.

Till the time there are real economic reforms taken up, economic growth will lag and therefore the opportunities to invest one’s surplus will be restricted. Mere tinkering with monetary policy will not help the economic activity. Reforms in the land, labour market and taxation are need of the day and unless the governing bodies of the country take bold steps in providing the opportunities for people to undertake economic activities at globally comparative costs with an enabling regulatory environment, the economic growth is going to lag. The stock market may not be the barometer of the economy, but it does notice the impact the policies of these institutions have on the economy. It has been silent till date occasionally frowning. But if push comes to shove, it may as well dive.

- By Vishal Vora, Nishant Maheshwari

Disclaimer: The above article is based on views expressed by the authors and are meant for information purpose only. Readers are requested to take investment decisions by consulting financial advisors.

I appreciate your analytical approach I all your data based research articles n can say that you have a long way to go

LikeLiked by 1 person

Thank you so much sir

LikeLike

I appreciate your analytical approach in all your data based research articles n can say that you have a long way to go .Keep it up .

LikeLike