As a Fellow Investor Community, we always try to dig put data which is more supported by Financial numbers and least driven by market noise. Since 2020 it is our first time to write about budget and its realistic numbers. While everyone is gung-ho while stating it a “Dream budget” in terms of Capex Reduction or Intention to reduce borrowings or “12 Lakh Income Tax Free” etc etc and on the other side the same analyst were stating that Capex is good part and increased borrowings can result in development etc The analysts are same but thought process always remained in dream. Therefore, our Indian Budget is always dream budget.

Today we will divide our blog in three aspects after overall analysis. The three aspects will be as under:

- Financial Stats of Government actual number and estimated number

- Debt Front

- Taxation front

Financial Stats

Today let us emphasise the number or financial stats of items since 2022-23 till 2025-26 (Budgeted). Base on same we will analyse the dream of this budget numbers.

The total receipts other than borrowings and the total expenditure are estimated at ₹ 34.96 lakh crore and ₹ 50.65 lakh crore respectively.

The net tax receipts are estimated at ₹ 28.37 lakh crore.

The fiscal deficit is estimated to be 4.4 per cent of GDP.

The gross market borrowings are estimated at ₹ 14.82 lakh crore.

Capex Expenditure of ₹11.21 lakh crore (3.1% of GDP) earmarked in FY2025-26.

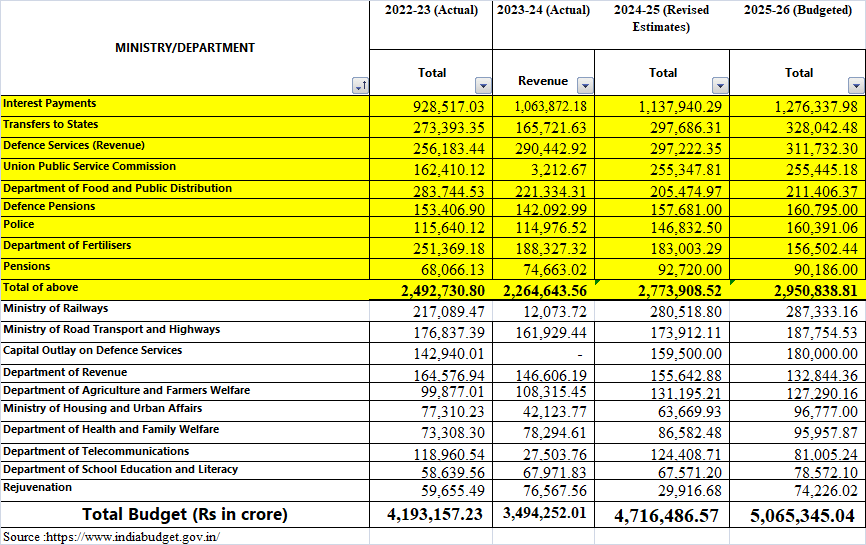

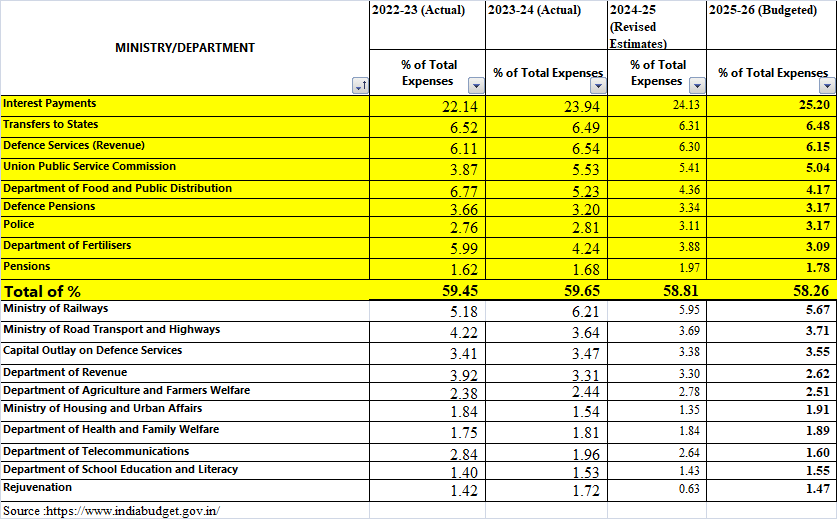

The numbers stated below does not include department which represents less than 1% of Budget estimate of 2025-25. However, the same can be less than 1% for 2022-23 (Actual) or 2023-24(Actual) and 2024-25 (Revised Estimate):

(a)Expenditure

It is interesting to see that since 2022-23, our interest payment has increased by 3,47,820.95 crore which now accounts for 25.20% of overall budget.The department marked in yellow which includes subsidies and food distribution accounts for 58-59% of overall budget allocation. In nutshell, only 41-42 % only accounts for real GDP. India as a developing country is using one fourth budget interest payment and other one fourth of budget for non- gross value addition. Balance 40-45% also includes salary of Government employees. So in nutshell when the Government announced a lot of Government order, the amount of receivables in Books of corporate against such tender will be further pending for longer period of time in upcoming years due to non-availability of resources. For instance Ministry of Railways where the increment in allocation of last two years is 4,500 crore and 6800 crore. The allocation for industry which can contribute to capex has also substantially decreased.

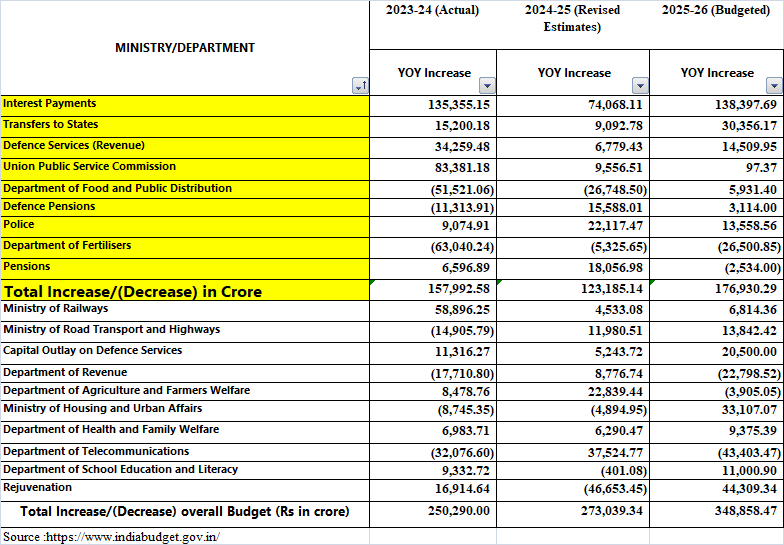

- Receipt

The receipt of 2023-24 actual, revised estimate of FY 2024-25 and 2025-26 (Budgeted) is as under:

Source :https://www.indiabudget.gov.in/

It is interesting to note that the Government in its 6.30% in FY 2025-26 while real GVA is estimated at 6.40% in FY 25 which is lowest since pandemic crisis of 2020, the government is estimating an incremental corporate Tax of Rs 102000 crore. Surprisingly, the Corporate Tax has been decreased from 10,20,000 crore in Budget estimate of FY 2024-25 to 9,80,000 crore in revised estimate of FY 2024-25. Similarly the Government has foregone more than 1.00 lakh crore by announcing no Tax on Income till Rs 12 Lakh(Excluding Capital gain Income) while the Government has increased estimate by Rs 1,81,000 crore under the head “Taxes on Income” to Rs14,38,000 Crore from 12,57,000 crore. Same applies to estimated GST collection where an incremental GST of Rs 1,16,101 crore is projected while GDP numbers have been revised downwards. All in all an overestimation of Rs 3,99,101 crore has been over estimated in collection without taking impact of 1.00 Lakh crore.

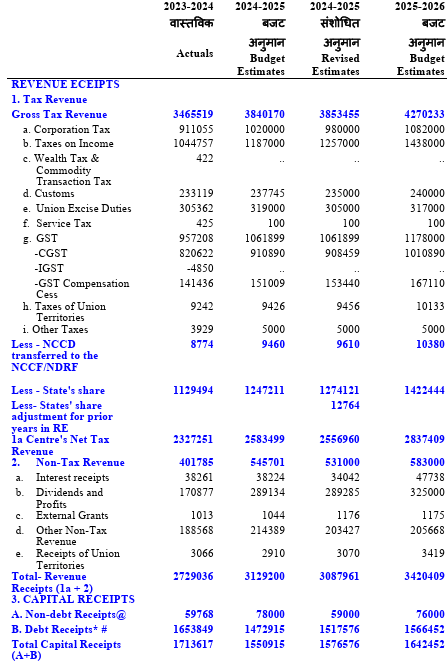

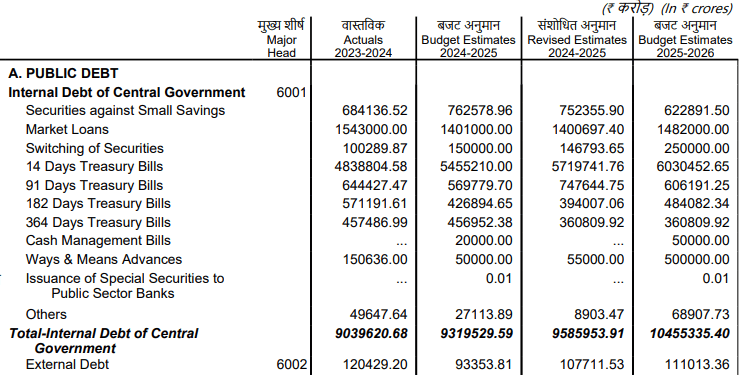

Debt Stats

The Debt of a Developing nation is always a burden when it comes to slowdown. Since the revision of GDP to its lowest since pandemic is indicating slowdown, the debt management becomes more of a challenging task of a developing nation like India. Let us analyse the number stated below:

Source :https://www.indiabudget.gov.in/

It is interesting to see that to finance our fiscal deficit in FY 2023-24 was Rs 16,53,849 crore, FY 2024-25(Estimated) 15,76,476 crore and for FY 2025-26 (budgeted) is Rs 16,42,452 crore. The total of Debt in these years will be 48,72,777 crore while the GDP is projected to be on a downward side.

Interestingly the size of 14 days treasury Bills increased from 48,38,804.58 crores in FY 2023-24 to Rs 60,30,452 crore representing Rs 11,91,647.42 crore increase. This represents serious rating issue for a developing country like India in upcoming years as the country will be overhanged with coercioning creditors looking for repayment of debt or hanging our country currency every time. The external debt of our country has decreased from Rs 1,20,429 crore to 1,11,013.36 crore but the currency has shattered the lower interest cost benefit and resulted in heavy interest payment in last three years.

Taxation Front

(a) Direct Tax

- No personal income tax payable upto income of Rs 12 lakh (i.e. average income of Rs 1 lakh per month other than special rate income such as capital gains) under the new regime.

- This limit will be Rs 12.75 lakh for salaried tax payers, due to standard deduction of Rs 75,000. Revenue of about ₹ 1 lakh crore in direct taxes will be forgone.

- The new structure will substantially reduce the taxes of the middle class and leave more money in their hands, boosting household consumption, savings and investment.

- The new Income-Tax Bill to be clear and direct in text so as to make it simple to understand for taxpayers and tax administration, leading to tax certainty and reduced litigation.

- Rationalization of Tax Deduction at Source (TDS) by reducing number of rates and thresholds above which TDS is deducted.

- The limit for tax deduction on interest for senior citizens doubled from the present Rs 50,000 to Rs 1 lakh.

- The annual limit of Rs 2.40 lakh for TDS on rent increased to Rs 6 lakh.It is to be noted that the limit is Rs 50,000 per month and the payment is more than Rs 50,000 per month and total rent is below Rs 6,00,000/- then TDS is still liable to be deducted

- The threshold to collect tax at source (TCS) on remittances under RBI’s Liberalized Remittance Scheme (LRS) increased from Rs 7 lakh to Rs 10 lakh.

- The provisions of the higher TDS deduction will apply only in non-PAN cases.

- Decriminalization for the cases of delay of payment of TCS up to the due date of filing statement.

- Reduction of compliance burden for small charitable trusts/institutions by increasing their period of registration from 5 years to 10 years for trust having receipt of Rs 5 crore to Rs 10Crore

- The benefit of claiming the annual value of self-occupied properties as nil will be extended for two such self-occupied properties without any condition.

- Introduction of a scheme for determining arm’s length price of international transaction for a block period of three years.

Expansion of the scope of safe harbour rules to reduce litigation and provide certainty in international taxation - Exemption of withdrawals made from National Savings Scheme (NSS) by individuals on or after the 29th of August, 2024.

Similar treatment to NPS Vatsalya accounts as is available to normal NPS accounts, subject to overall limits. - Presumptive taxation regime for non-residents who provide services to a resident company that is establishing or operating an electronics manufacturing facility.

- Introduction of a safe harbour for tax certainty for non-residents who store components for supply to specified electronics manufacturing units.

- The benefits of existing tonnage tax scheme to be extended to inland vessels registered under the Indian Vessels Act, 2021 to promote inland water transport in the country.

- Extension of the period of incorporation by 5 years to allow the benefit available to start-ups incorporated before 1.4.2030.

- Certainty of taxation on the gains from securities to Category I and Category II AIFs which are undertaking investments in infrastructure and other such sectors.

- Extension of the date of making investments in Sovereign Wealth Funds and Pension Funds by five more years, to 31st March, 2030, to promote funding from them to the infrastructure sector.

(b) Indirect Tax

- Remove seven tariff rates. This is over and above the seven tariff rates removed in 2023-24 budget. After this, there will be only eight remaining tariff rates including ‘zero’ rate.

- Apply appropriate cess to broadly maintain effective duty incidence except on a few items, where such incidence will reduce marginally.

- Levy not more than one cess or surcharge. Therefore Social Welfare Surcharge on 82 tariff lines that are subject to a cess, exempted.

Revenue of about ₹ 2600 crore in indirect taxes will be forgone. - 36 lifesaving drugs and medicines fully exempted from Basic Customs Duty (BCD).

- 6 lifesaving medicines to attract concessional customs duty of 5%.

- Specified drugs and medicines under Patient Assistance Programmes run by pharmaceutical companies fully exempted from BCD; 37 more medicines added along with 13 new patient assistance programmes.

- Support to Domestic Manufacturing and Value addition

- Cobalt powder and waste, the scrap of lithium-ion battery, Lead, Zinc and 12 more critical minerals fully exempted from BCD.

- BCD rate on knitted fabrics revised from “10% or 20%” to “20% or ` 115 per kg, whichever is higher.

- BCD on Interactive Flat Panel Display (IFPD) increased from 10% to 20% .

- BCD reduced to 5% on Open Cell and other components.

- BCD on parts of Open Cells exempted.

- 35 additional capital goods for EV battery manufacturing, and 28 additional capital goods for mobile phone battery manufacturing exempted.

- Exemption of BCD on raw materials, components, consumables or parts for the manufacture of ships extended for another ten years.

The same dispensation to continue for ship breaking. - BCD reduced from 20% to 10% on Carrier Grade ethernet switches.

- Time period for export extended from six months to one year, further extendable by another three months, if required.

Nine items added to list of duty-free inputs. - BCD on Wet Blue leather fully exempted.Crust leather exempted from 20% export duty.

- BCD reduced from 30% to 5% on Frozen Fish Paste (Surimi) for manufacture and export of its analogue products. BCD reduced from 15% to 5% on fish hydrolysate for manufacture of fish and shrimp feeds.

- Railways MROs to benefit similar to the aircraft and ships MROs in terms of import of repair items.

- Time limit extended for export of such items from 6 months to one year and made further extendable by one year.

- For finalising the provisional assessment, time-limit of two years fixed, extendable by a year.

- A new provision introduced to enable importers or exporters, after clearance of goods, to voluntarily declare material facts and pay duty with interest but without penalty.

- Time limit for the end-use of imported inputs in the relevant rules extended from six months to one year.Such importers to file only quarterly statements instead of a monthly statement.

From CA Nishant Maheshwari & Vishal Vora

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Number: 00000037522669317

Account Holder Name:Rashi Maheshwari

IFSC:SBIN0030115

SBI Indore, YN road