A typical business cycle involves the fed cutting rates in the downturn to prop the economy, capital flows in to veins of the economy and risk taking increases, the economy activity grows and then as rates start rising as demand for capital increases eventually leading to slowdown. All this happens through debt taken by the central bank and bailing out private players. But over the years the system has developed some symptoms too hard to ignore.

The world is washed with debt. And that debt is creating problems in places we don’t really think it would. Takes Trump’s tariff regime. Most think it is a policy to bring production home. Yes but haven’t they tried it long back. So, what is the relation.

The US national debt surpassed $37 trillion in August 2025, crossing this milestone years ahead of pre-pandemic projections. This figure is now larger than the size of the country’s entire economy, with US GDP estimated at $30.3 trillion. The trajectory of debt accumulation has accelerated sharply: the last $1 trillion was added in just 60 days, and currently, the pace is roughly $1 trillion every 5 months, more than twice the previous average.

This rapid surge in debt stems from extensive borrowing during the pandemic, increased social spending, recent tax reductions, and continuous fiscal stimulus measures. Trump’s “One Big Beautiful Bill” alone is projected to add about $4 trillion to the debt in the next decade. As the debt burden increases rates shift upwards causing buyers of that treasuries to go elsewhere. The Tariffs are a way to bring money to buy treasuries.

Tariffs are not a new tool. Previous attempts to ‘bring manufacturing home’—such as 1980s tariffs and duties—were designed to protect domestic industry but had mixed results long-term. Trump’s aggressive tariff regime, especially since 2024, is seen as a bid to generate revenue and stimulate US factories, but:

Record Short-Term Revenue: Tariffs have pumped billions into federal coffers. For example, customs duties in July 2025 jumped 273% YoY, bringing $21 billion that month.

Insufficient for Deficit Control: Despite the windfall, the deficit keeps widening, and tariffs alone are nowhere near enough to offset surging debt and spending. Tariffs are a minor contributor compared to entitlement programs, post-pandemic stimulus, infrastructure, and tax cuts.

Incremental fixes like tariffs cannot reverse the fundamental problem of chronic overspending relative to revenue. Sustainable solutions require broader reforms to taxation, entitlement programs, and spending priorities.

America’s record debt is now driving the tariff regime—not just as a jobs policy, but as a desperate effort to fund runaway deficits. The debt is larger than ever, rising fast, and the knock-on problems—higher costs, reduced investment, and rising interest—are spreading across the economy in unexpected ways. Tariffs, once a tool to spur manufacturing, are now more like fiscal band-aids—and the prognosis for America’s debt crisis is increasingly urgent.

At what point do Americans realize that their debt is never going to get paid and their currency is FUBAR. Only thing supporting them is the world is even more messed up. In the short term the USA may be able to cut rates as Europe and other Asian countries are even more messed up. There have been 90+ rate cuts this year and USA hasn’t done anything yet so it may be the cleanest dirty shirt right now. But may be at 40 T USD debt burden, they decide to protect themselves. From a govt perspective there is a different problem. You try to see it from assets and liabilities side. The DOGE was an exercise to curtail the liability side and it failed in 7 months.

Asset side you have gold crypto and crude oil. America is championing the cause of crypto by bringing in regulations and clarity

President Donald Trump announced a “Strategic Bitcoin Reserve” in March 2025, consolidating forfeited assets into a federal store of value, intended as a sovereign reserve similar to “digital Fort Knox”. God knows what that is supposed to do given that hardly any payments can be done by Ethereum and Bitcoin. But by inflating value you create a reserve on the asset side. Also stablecoins use treasury as reserves which means they reduce the interest rates on debt by providing a willing buyer of treasury.

As of August 2025, the US government possesses around 200,000 Bitcoins, making it the largest known government holder of Bitcoin worldwide. This estimate is based on on-chain analysis and multiple sources monitoring government wallets, primarily reflecting consolidated reserves obtained through law enforcement seizures and asset forfeitures.

The US Marshals Service currently manages about 28,988 BTC, but this represents only a fraction of the total federal holdings. The majority is distributed across various agencies and not limited to the Marshals.

At current prices, the US government’s Bitcoin holdings are worth over $23 billion.

Let’s look at oil. Globally oil is abundant. Oil is a recycled commodity by mother nature. What goes in the earth especially dead trees and organic matter is converted to oil all it takes is time. So there is never a shortage of oil but there can be a shortage of processing facility. There have been a numerous accidents and acts of war that have destroyed processing facilities world over. First was a play to stop Russian gas to Europe so that was met by imports world over especially India then comes news of America asking India to stop buying oil from Russia. Add to this, threats from its neighbour of attacking crude refining facilities in India from USA soil. Meanwhile Iran gets bombed and many refineries especially in middle East are attacked. Global refining capacity has had its slowest pace of growth this decade. In fact most years have seen a fall except for a year or so (2023).

We are concerned this may lead to a spike in crude prices and may stoke inflation in medium term.

In 1970s, crude oil prices flared with gold and silver and inflation wrecked havoc reducing the value of the dollar. Now that the debt burden is heavy and there are limited options is another asset price bubble emerging in crude to maintain the balance sheet stability?

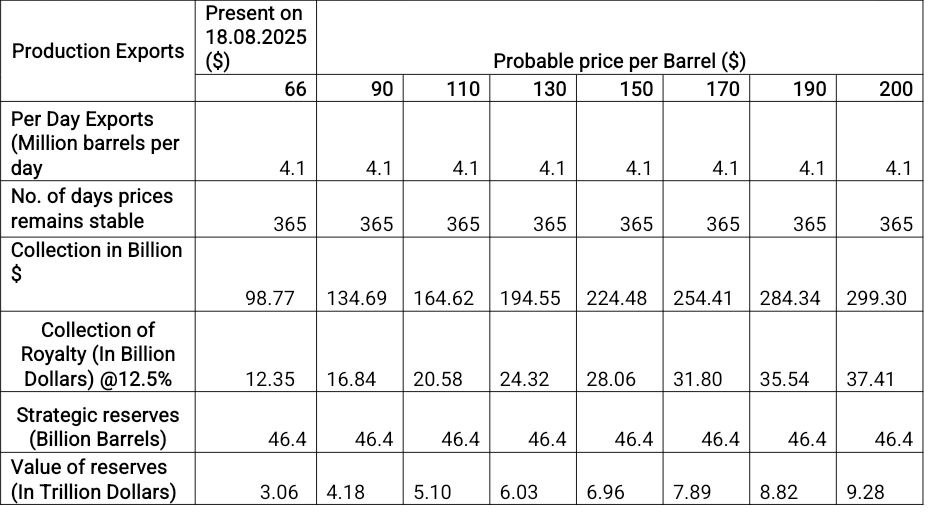

The United States exports over 4.1 million barrels per day (b/d) of crude oil as of 2024, and is projected to maintain similar volumes in 2025. Additionally, total petroleum product exports—including refined fuels like gasoline, diesel, and jet fuel—average about 6.6 million b/d. The top destinations for US crude oil exports in 2025 include the Netherlands (825,000 b/d), South Korea, Canada, and India.

The US currently holds around 35–38 billion barrels of proven crude oil reserves according to the US Energy Information Administration (EIA) and international benchmarks. This figure reflects technically recoverable oil using current methods and technology. Advanced extraction techniques (hydraulic fracturing, horizontal drilling) have enabled the US to maintain its position as the world’s largest oil producer, with record production estimated at 13.41 million b/d in 2025.

The US total proven crude oil reserves (in-ground and technically recoverable) are around 46.4 billion barrels at the end of 2023, reflecting a slight decrease from the prior year.

The US government directly controls the Strategic Petroleum Reserve (SPR), which currently contains about 395.3 million barrels (as of March 7, 2025).

The standard federal royalty rate for crude oil (including shale oil) is typically 12.5% to 18.75% of the market value of oil produced. The exact rate depends on the location (onshore vs. offshore), lease terms, and occasionally policy changes. Federal royalty rates for shale and conventional oil typically range from 12.5% to 18.75% of production value.

So lets do a match this time to calculate the current and probable impact on US Government Financial Statement for crude oil:

As it is visible that in spite of such strong increase in prices of crude with stabilized prices for one year, the things remained challenging considering the impact of debt and substantial increasing momentum.

Gold and silver are already on a tear and they can’t be managed much because China and Russia and global central banks in particular are heavily buying it.

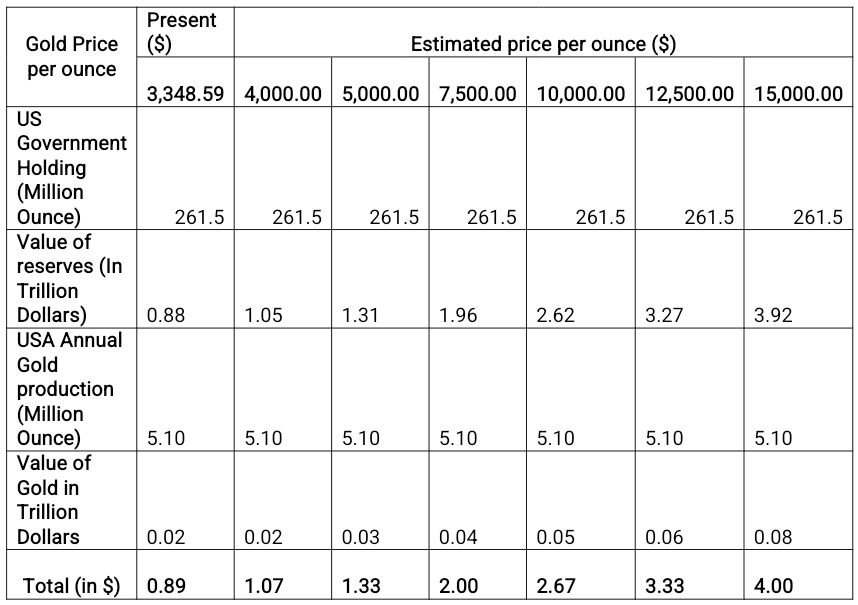

Now let’s analyse the value for reserves in Gold.

As of August 2025, the US government holds 8,133.5 metric tonnes of gold in its official reserves. This makes it the largest gold holder in the world and represents about 261.5 million troy ounces. The majority of these reserves are stored at Fort Knox, Kentucky, with additional holdings at other secure locations such as the Denver and West Point US Mints.

The official “book value” of this gold is based on an antiquated price ($42.22 per ounce), which puts the government’s official gold stock value at about $11 billion. However, at current market prices (above $3,300/oz as of August 2025), the market value of the US gold reserves exceeds $750 billion.Lets also have a mathematical calculation on records:

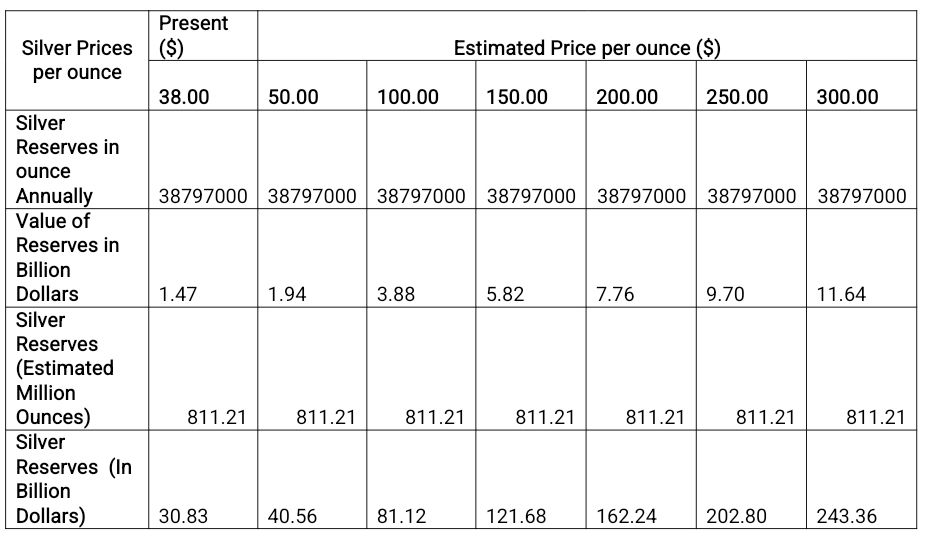

Similar is the analysis of Silver:

Considering all above instances with current scenario, the system is completely trapped into the debt spiral and the real sufferers are the citizens who just had freebees at cost of future destruction and are now trapped in this viscius situation. Debt burden is only citizens cost which keeps rising with rate of inflation. In short, the short term pain is also the long term pain. The lust of debt on each household in the name of Credit Card, Housing Loan, Commercial Mortgage and other things become a costly affair to the Government when defaults rises and all such bills are again raised to the citizens in the name of Inflation. So all in all the recycled cost is the inflationary reserves which are created with rising cost. But what if the assets are not sufficient to repay the bills, then the Government in cooperation with central banks makes a plan to reduce the amount of debt through capital loss to investors. That’s how the things are at present.

On the asset side, the US government is seeking to bolster reserves beyond traditional gold by incorporating cryptocurrencies such as Bitcoin into its strategic holdings, with around 200,000 BTC valued at over $23 billion. This move parallels extensive holdings in gold (8,133.5 metric tonnes valued above $750 billion at market prices) and crude oil reserves (about 395 million barrels in the Strategic Petroleum Reserve), underscoring efforts to preserve asset value amid fiscal strain.

Despite abundant oil production and exports—including 4.1 million barrels per day of crude oil and proven reserves of over 35 billion barrels—the economic environment remains precarious. Global refining capacity constraints, geopolitical tensions, and strategic manoeuvres in energy supply risk further price volatility and inflation spikes. Similarly, substantial silver reserves and annual production support the US monetary and industrial position but are insufficient to offset the growing debt liabilities.

In 1970s, when gold dollar peg was broken a similar situation had arisen; the dollar plummeted and gold, silver, oil went on a tear. The current situation is quite similar but when the whole world is awashed with debt, the currency can’t be devalued easily. But that stage may soon come when the dollar has to be devalued and it sparks a rally in the above assets causing the assets to balloon and provide some breathing space for the govt. as Ludvig von Mises said “Credit booms eventually end in either the currency losing value or deflation”. I guess no central banks want a deflationary end as it does not help their cause.

The US and global economies face a debt spiral where citizens bear the brunt through rising inflation and increased living costs. Trade wars exacerbate the problem by constraining goods and capital flows, reinforcing systemic rigidity. Without fundamental reforms to align revenues with spending, the system risks insolvency or severe inflationary correction, where creditor losses become inevitable or debt becomes cheap through currency devaluation.

What we can say is in the end the loss of creditors is the only option left when the system becomes unsustainable or else you need the path of hyperinflation where eventually the debt burden is reduced through worthless currency.

The existing fiscal and economic frameworks are unsustainable, and solutions require comprehensive policy shifts addressing both sides of the balance sheet—reducing liabilities and strengthening assets—while managing global economic interdependencies carefully to avoid harsher fallout. But this will require absorbing pain which no politician can do unless the world is in crisis. Hence we are heading to a debt crisis.

From CA Nishant Maheshwari and Vishal Vora

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Holder Name:Rashi Maheshwari

IFSC:SBIN0030115

Name of the Bank:SBI India, YN Road Branch, Indore, India

Account Number: 00000037522669317