CLO-Overview

It is a form of securitization where payments from multiple middle sized and large business loans are pooled together and passed on to different classes of owners in various tranches.

In short investors will have first claim on cash flows from the underlying loans.

Eg: Suppose a Bank has advanced Loan to following persons:

Mr A-$1 Million (Backed by Real Estate Property)

Mr B-$3 Million (Backed by Real Estate Property)

Mr C-$2 Million (Backed by Real Estate Property)

So, what will be situation in the Books of Banks. In simple terms, it will form part of Assets as advances to the extent of $6 Million. Now assume the Economy is in buzzing mode. In order to keep this buzz alive, Banks needs more liquidity to pump into the system. But at present situation on one hand is that the Bank has Liabilities or borrowed money which they advanced to Mr A, Mr B and Mr C against mortgage.

Now need of new liquidity forces Banks to derive new product called collateral Debt obligation.

How does this work?

Suppose one big fund is full of liquidity and he wants high yields. Bank approaches that customer and offers him that bundle of Loan fully backed by Mortgaged property (In our example Mr A, Mr B and Mr C) and assures him that the repayment of Mortgage from Mr A, Mr B and Mr C will carry first claim of Fund House. It’s done in the form of Tripartite Agreement and generally termed with Third Party risk.

The Present Situation in China

In China, the same concept was introduced back in 2008 wherein the product was renamed as Residential Mortgage-Backed Securities (RMBS). It’s right after Lehman Crisis.

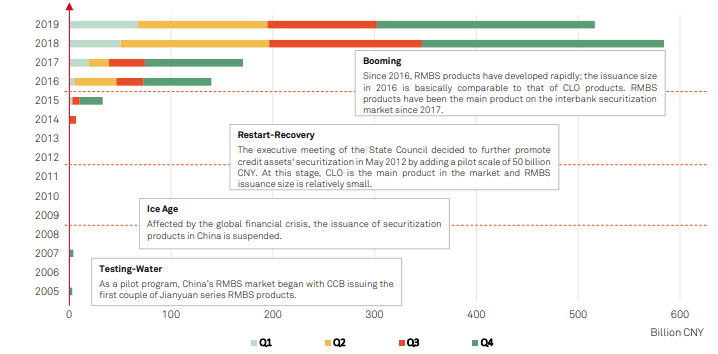

Till 2015, the product was not popular and was still under pilot stage of launching. But post 2016 the product picked up rampant pace amongst Chinese Investors. Like Non-Banking Financial Services Entities in India, many business tycoons formed various such series of investment corporations to invest in these products along with Chinese individuals. In 2017, China allowed foreign creditors participation for various products. This resulted in multi fold growth of this product. Like every high yield product that comes with greedy participants and risky assets, this product is not different from other Ponzi scheme. The rush for this product was not only prominent amongst Chinese citizens or Foreign creditors but various Private Banks which are not owned by CCP or PBOC were aggressively increasing holdings for these products.

(From S&P Global China rating)

(Till 2019, roughly $85 Billion is in RMBS. In further two years, this size have grown to more than $100 billion as many China saw maximum inflow of foreign currency inflow post pandemic due to highly lucrative yields.)

Till the time you have money in the pocket the risk of leverage is very low as the investment relates to your own money. But without leverage, none of the Ponzi schemes can be created to cloud 7 level. The greedy private banks started to look beyond own capital. This RMBS is now widely accepted as collateral by Banks in China. The same is now used in Repo market.

e.g.: If you have $100 own capital and you buy $100 RMBS. The risk is related to default of $100 if mortgage defaults happen. Now what if that $100 RMBS is used as collateral in Bank and Banks lend you further $60 against that $100 collateral. You again buy $60 RMBS then again put it into collateral banks lend you $36 and again you buy $36 worth RMBs and this process goes on and on.

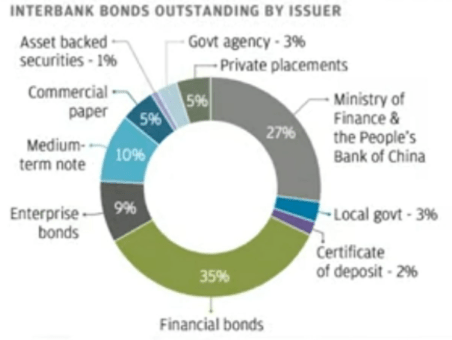

Note: The 5% Private Placement includes RMBS. The data is of 2015. The data as on 2021 will be completely different.

Considering this example, we can clearly see how leverage is playing out. Out of your own capital of $100 you are owning RMBS of worth $196 which put your books at debt-to-equity ratio of 1:1 (Approx.) but at the end you will be fearful of mortgage delinquencies.

In 2008 Global Financial Crisis, the delinquencies increased from 4.6% to 10% (approx.) but the value of CDO’s (in our case RMBS) plunged to 0.

In case of US, the value of US properties was of few trillions against half a trillion dollars worth of investments. So, at that time, the plunge in property price with just double rate delinquencies caused a systemic risk globally.

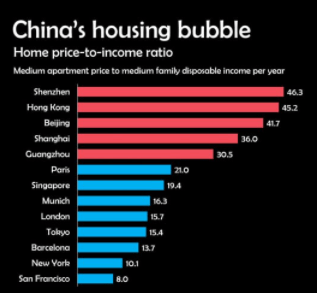

At present, situation in China the real estate notional value touched $52 trillion as against $1.4 trillion dollar investment. Taking this example let us look on the Chinese Banking system. Usually Banks lend against properties/house at 60% of market value. However, the market value of properties in Shanghai is just double than the cost of house in Los Angeles.

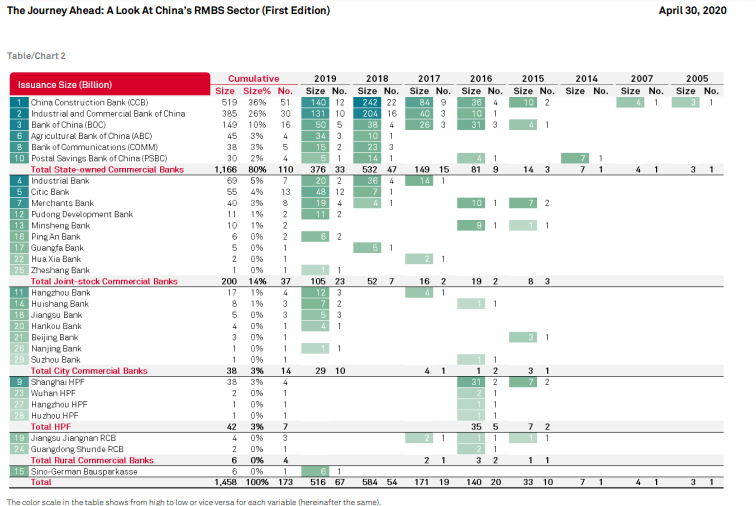

Source: S& P Global Ratings 2020

The gap between the average income of person in China to the cost of housing is 1:46 i.e. highest after Hongkong and other first world nations. So, the king of wealth inequality reflected is just unimaginable.

How does it pose risk to Banking system?

As written in earlier article, more than $4 trillion loans belong to real estate market which includes the Buyers and Developers.

Now let us assume that roughly $1 trillion dollar loan belongs to Real Estate developer and $3 trillion loans belong to ultimate consumers. So, the total value of collateral is roughly $7 trillion. Till date, its difficult to get data related to delinquencies in real estate and Banks were least concerned as there was abnormal increase in valuation of real estate since last many years. So, even if the ultimate buyer goes into default, the recovery of property helped bank to recover the loan amount. This created the misconception in the minds of Banks and buyers of property that prices of real estate will always go up as they were experiencing it since last 20 years.

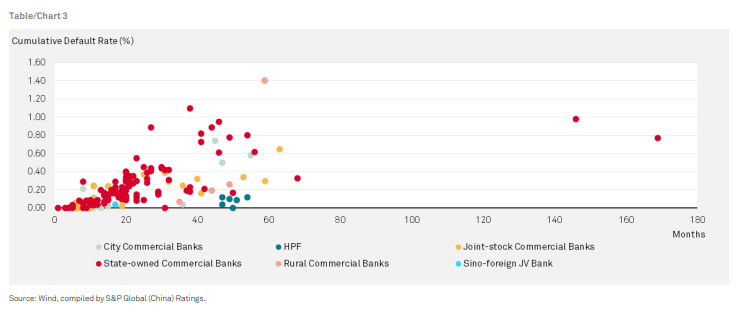

From S&P Global Credit Rating

Now with risk of Evergrande default (Second largest developers), Chinese Banks are getting a real risk on value of collateral. Like other developers, Evergrande received full amount against Booking of flat from more than 1 million customers. These all are under construction projects which will be completed in more than 2 years if everything gets normalized. Further, Evergrande has 817 projects under construction. It should also include un booked inventory too. At one side, it took loan from Banks for whole project by giving land, Building and Booking amount as security against loan. It also took short term commercial papers or Bills of Discount at super abnormal rate of 15 to 20% since last few years in order to meet out the liability of many creditors who were supplying goods and services to Evergrande.

Along with this, they were owning 37% stake in Shenjiang Bank from where they asked other customers and employees to buy Wealth Management products which offered lucrative yields but had 2 years lock-in period. Those products were nothing but in simple terms Loan derivative products. Ultimately that money is again routed to Real Estate business or its other businesses.

Now since the failure of Evergrande is certain and CCP is in silent mode so can this be the alternate course of action which CCP is looking upon?

Whether they will ask for other real estate developer to take over the projects and complete it?

It seems to be impossible as the failure is from second largest developer which requires more than 8 developers (cumulatively) of its size to take over the project and complete it. But considering the booking amount received, situation against under construction properties and location factor, no other developer will be in a situation to take over its project as it will require ample amount of liquidity which none of the largest developers have in their own books of accounts. The top ten developers whose documents are available in public domain have lot of stress in the books and one can easily see the cash crunch in books and service of loan is becoming difficult for them.

If it happens, then developers will require ample of liquidity to be guaranteed by PBOC or CCP without collateral. This can again defer the risk but will result in substantial downgrading in near future.

Whether CCP will allow Evergrande to Default?

Seeing the present crackdown of CCP on various sectors and silence on Evergrande fiasco, if such situation happens then we can see distress selling of various real estate properties which can crash the property market by more than 50% in very short span of time. This can happen at the level of category of buyer:

In China we have three categories of buyers:

- One is cash who will only care about the recovery of amount even at distress selling. He will not care about loss as the intention be directly related to recover as much amount as possible and get rid of the situation.

- Second person is the person who took loan against property i.e the person is holding 3 properties. He raised loan from Bank by putting third property as collateral from Bank. But if he sees that it will be difficult for him to repay the same in future against such Evergrande situation, he will be willing to sell his third property or second property to meet out his loan obligation. This is again another distressed situation.

- The most vulnerable and delinquencies can come from first home buyer who took loan against that property whose value of collateral is now nil. Believing from past history delinquencies touch 9-10% mark then the value of RMBS will become nil and it will expose the leverage of foreign creditors and domestic institutions who are not supported by CCP or PBOC.

This will further create systemic risk in the books of banks as well as other real estate developer as the value of collateral will substantially drop and will create havoc in credit market. The Banks will be forced to ask margins from Customers of other real estate developers against those existing Loan against property. Will they be able to put margin or will be forced to sell those properties will again depend on the type of intervention by PBOC.

Conclusion

If CCP wants to reduce those wealth inequality gap then destruction of inflated growth, haircut and reconstruction is the only way to create prosperity.

CCP knows that the world is also drowned in debt and they don’t have repayment capacity too but they are dancing on with the liquidity bubble. So, before the situation gets serious for the whole world, CCP wants to fix its own credit system by haircuts which will ultimately deleverage the books. This will ultimately help in longer run to come out the trap created by Credit market system. As it is rightly said that the real GDP is created by value addition of resources through right allocation rather than misallocation of resources. That’s what China is looking for future. The future is in doing real business out of judicious allocation of resources.

– By Nishant Maheshwari, Vishal Vora

Disclosure: This article is opinion of the writer and not a financial opinion. Please consult your financial advisor for any financial advice.

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Number: 00000037522669317

Name: Rashi Maheshwari

IFSC Code: SBIN0030115

Name of Bank: SBI India, YN Road Branch, Indore-India

great article, everyone is trying to put evergrande behind, but it is really not about evergrande itself just like ’08 was not about one entity (eg: lehman).

china is smart in deleveraging first, it will be hard to deleverage when everyone tries to do it at same time.

global co-ordinated central bank actions over the past decade were really huge. Debt and leverage is spread into lot of sectors, even SPACs, PE, NFT/crypto etc. Leverage is systematic, not just high-level players such as banks or advanced players.

LikeLike

Thanks sir

LikeLike

A very unique take. Thank you Mr Nishant

Regards Nithin I

On Sat, Sep 25, 2021 at 6:03 AM The Fellow Investor wrote:

> TheFellowInvestor posted: ” CLO-Overview It is a form of securitization > where payments from multiple middle sized and large business loans are > pooled together and passed on to different classes of owners in various > tranches. In short investors will have first claim on cash fl” >

LikeLike

Thank you so much sir

LikeLike