Korea is one of the few countries that has successfully transformed itself from a low-income to a high-income economy and a global leader in innovation and technology. The Korea office works with Korean partner institutions to help developing countries learn from Korea’s experience and expertise.

But the recent development of Political Turmoil has created a spoiler for such a highly developed economy when the South Korean President declares Martial Law, claiming the opposition is involved in anti state activity.

The sudden news has resulted in free fall of South Korean currency Won which was claimed as so “Self-Coup” by the President.

Coming onto the business point.How the turmoil of South Korean Politics should be viewed in terms of MSCI index?

MSCI indexes are market cap-weighted, meaning stocks are weighted according to their market capitalization.

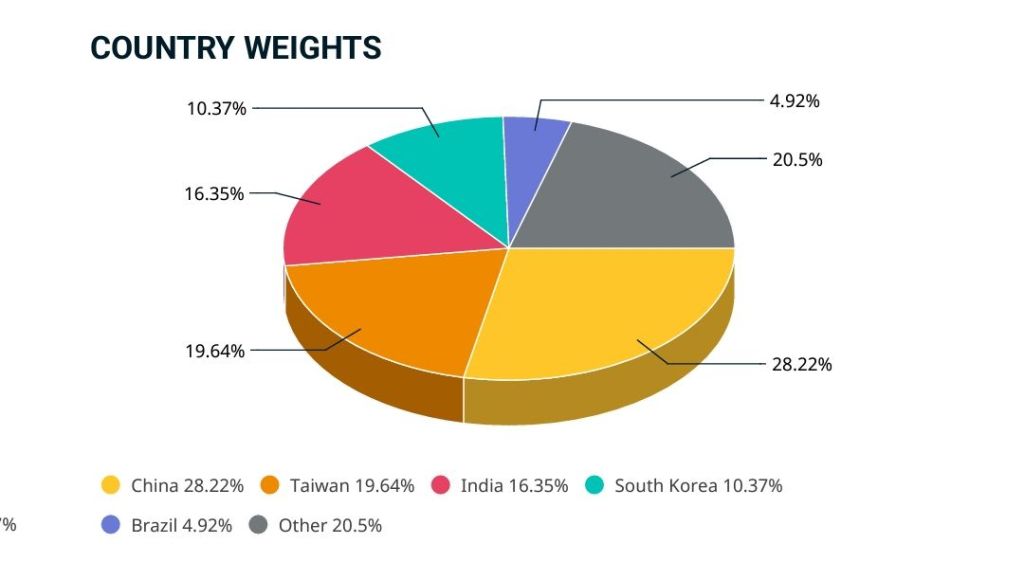

At present South Korea weight in MSCI Emerging Market index is 10.37%

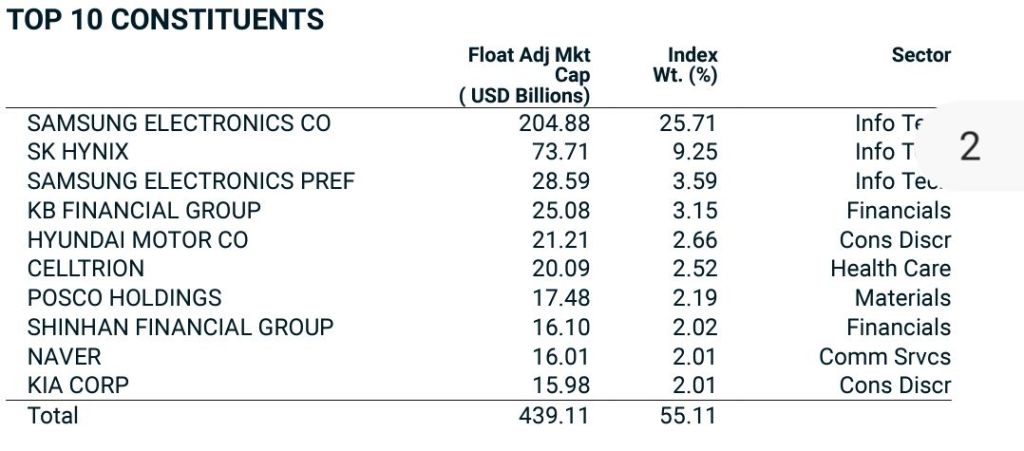

Amongst the top ten constituents, Samsung Electronics Co. Holds 2.67% weight while Parent Index weight is 2.59%

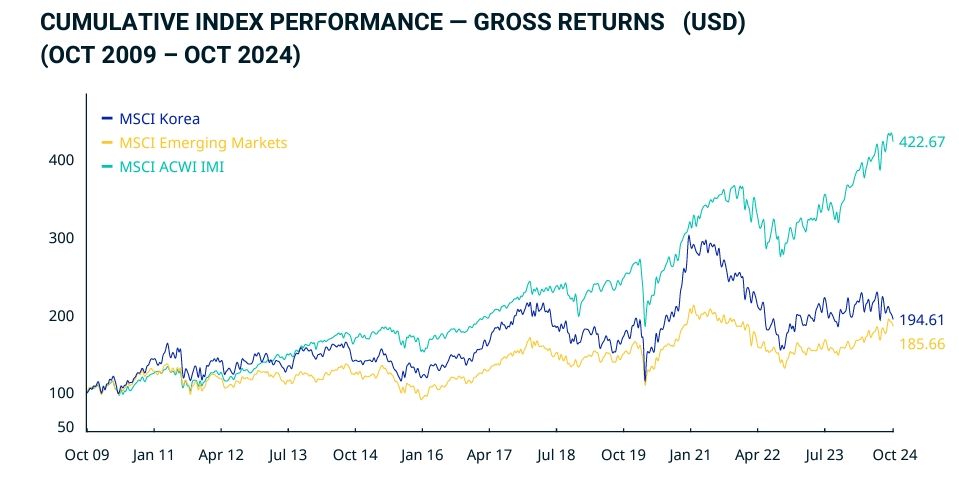

While under the MSCI EM index, the size of Korean stocks in USD185 Billion and the total size of MSCI korea is roughly USD 422.67 Billion.

Interesting facts about the Korean Market is that in October 2024, South Korea’s market capitalization was $1,780.185 billion where 32.3% i.e $456 billion is held by Foreign Institutional Investor and balance is held by Domestic institutions and retailers.

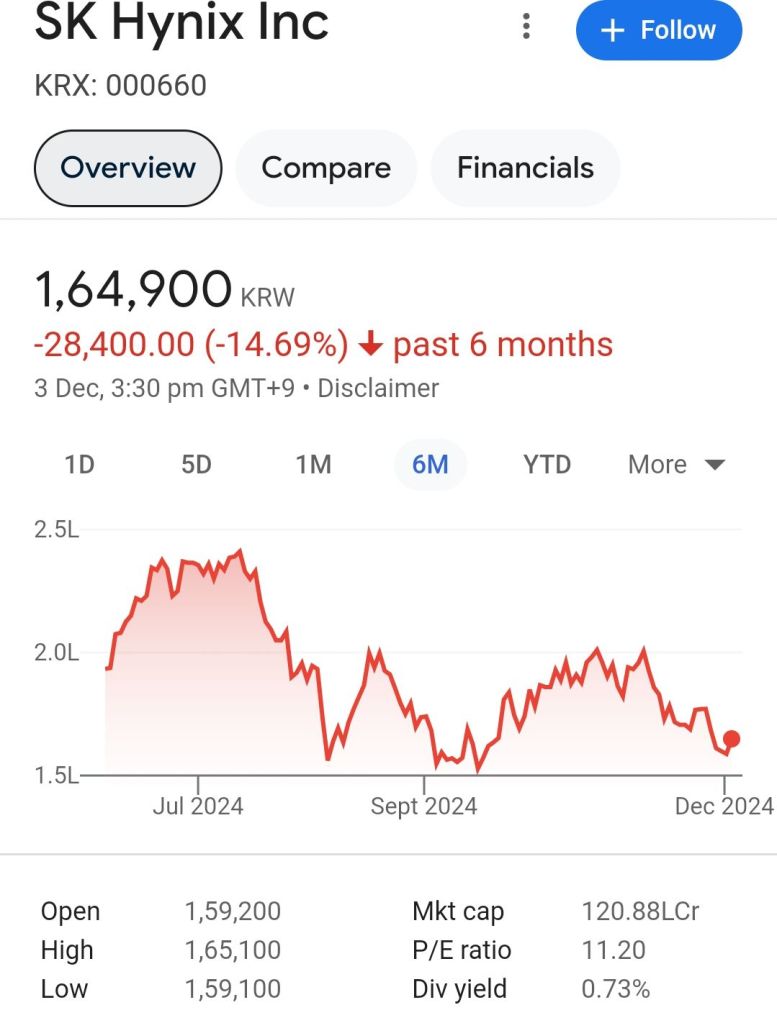

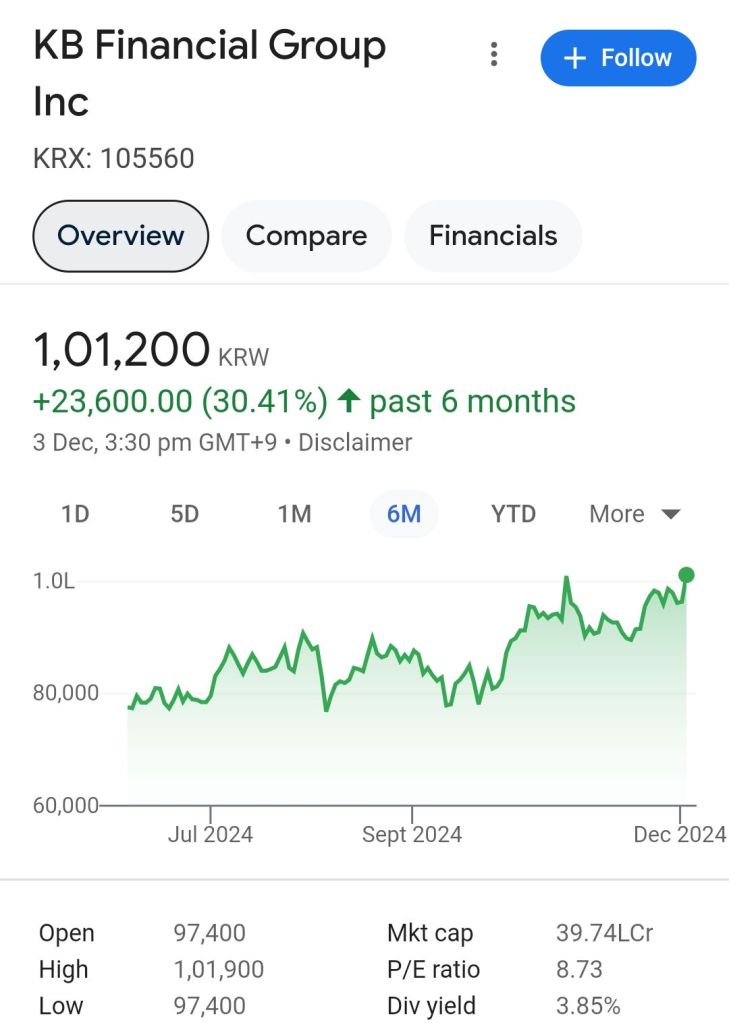

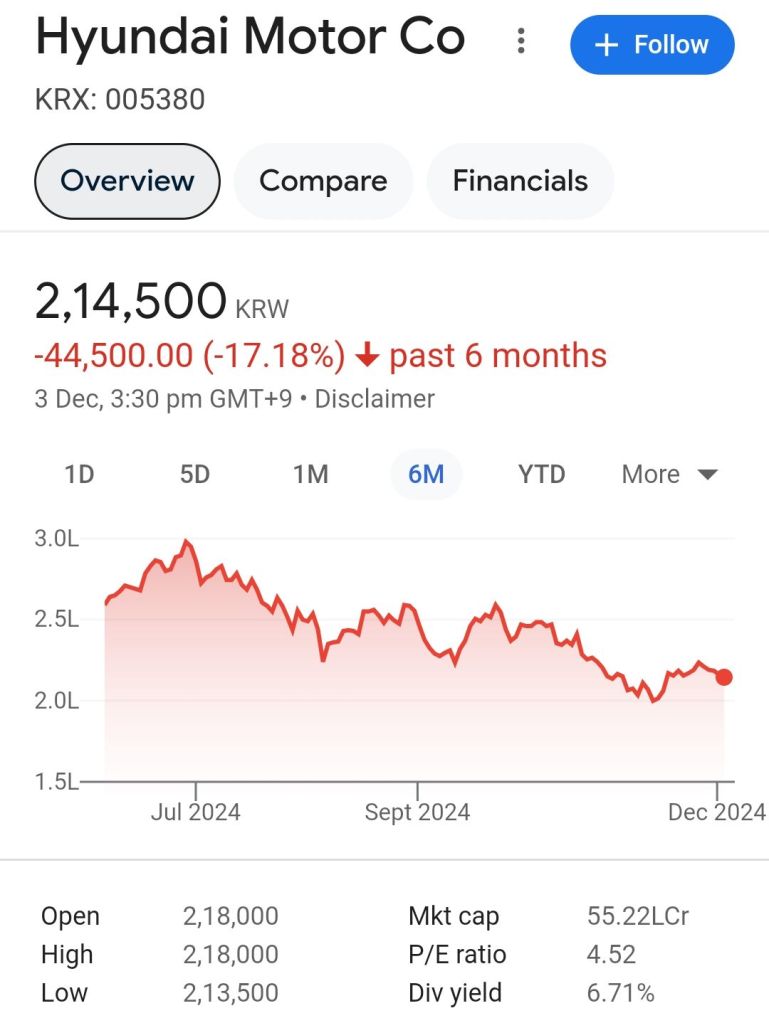

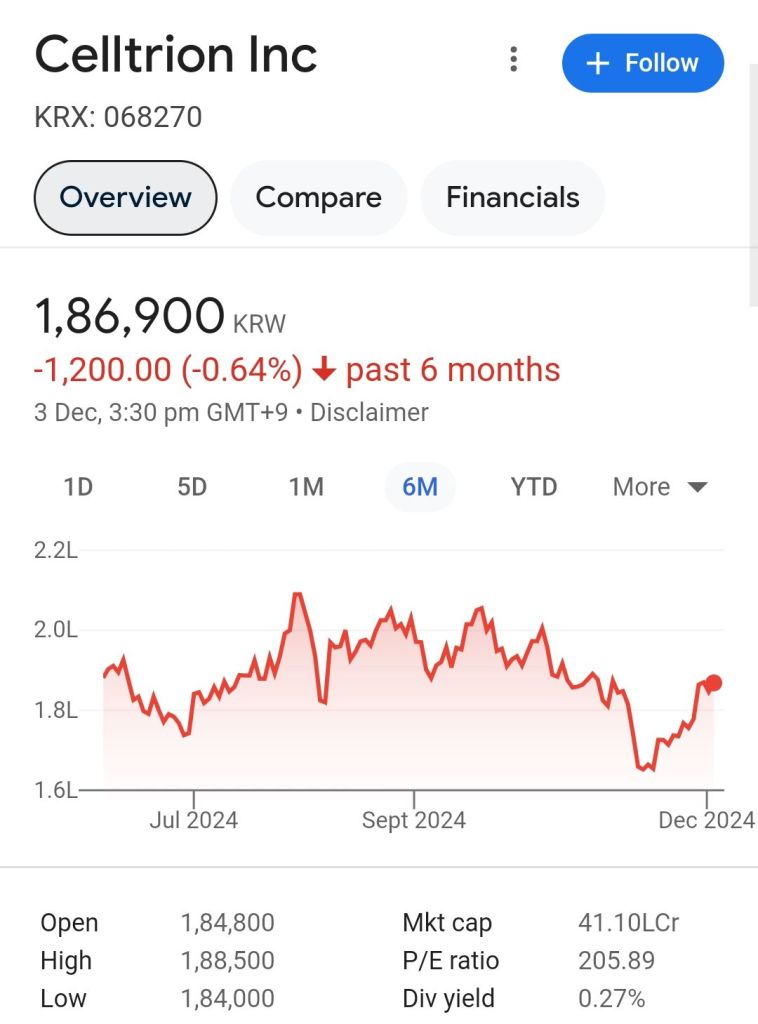

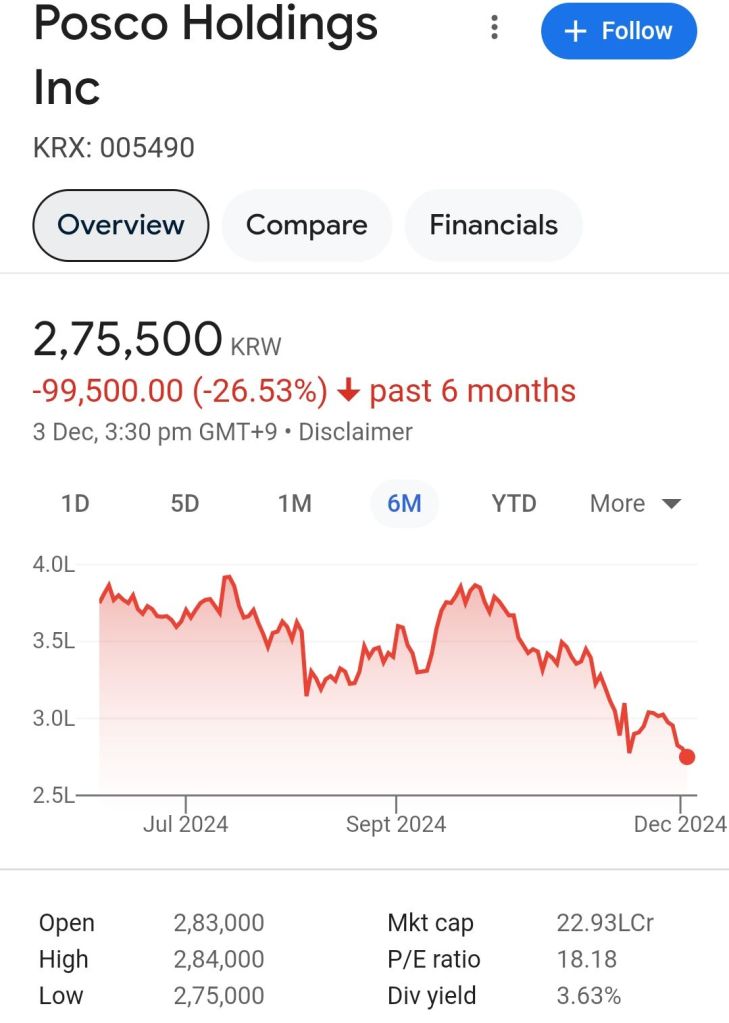

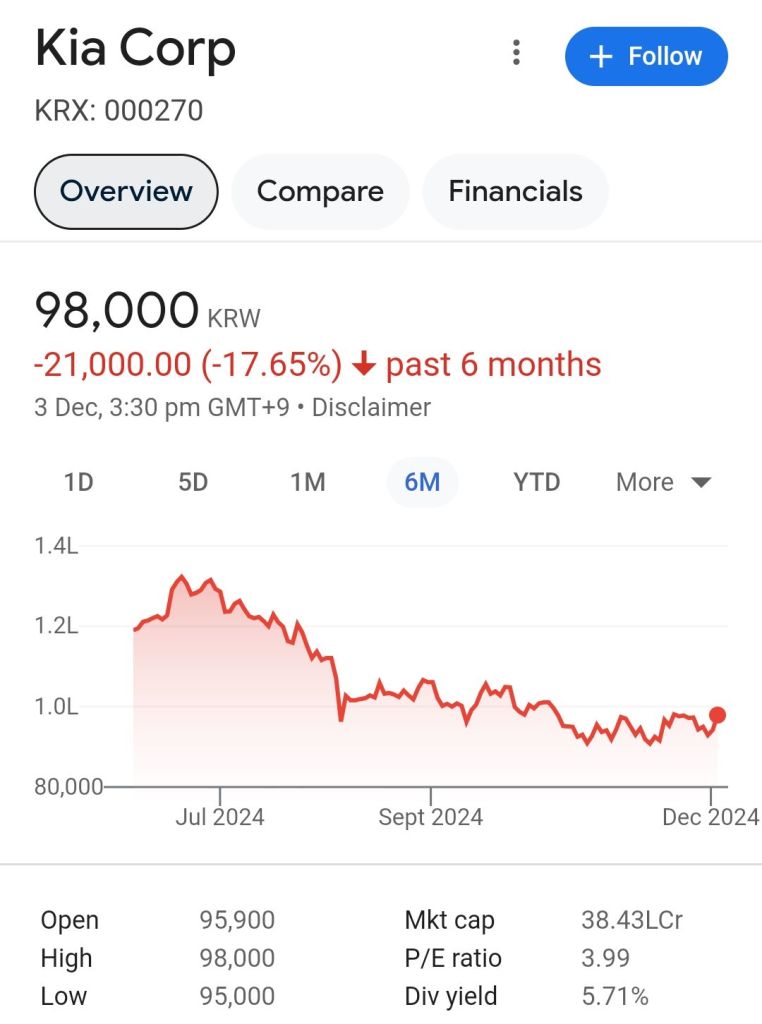

Looking at some Large Cap of Korea and what constitutes a large cap,the chart below will describe the weights.

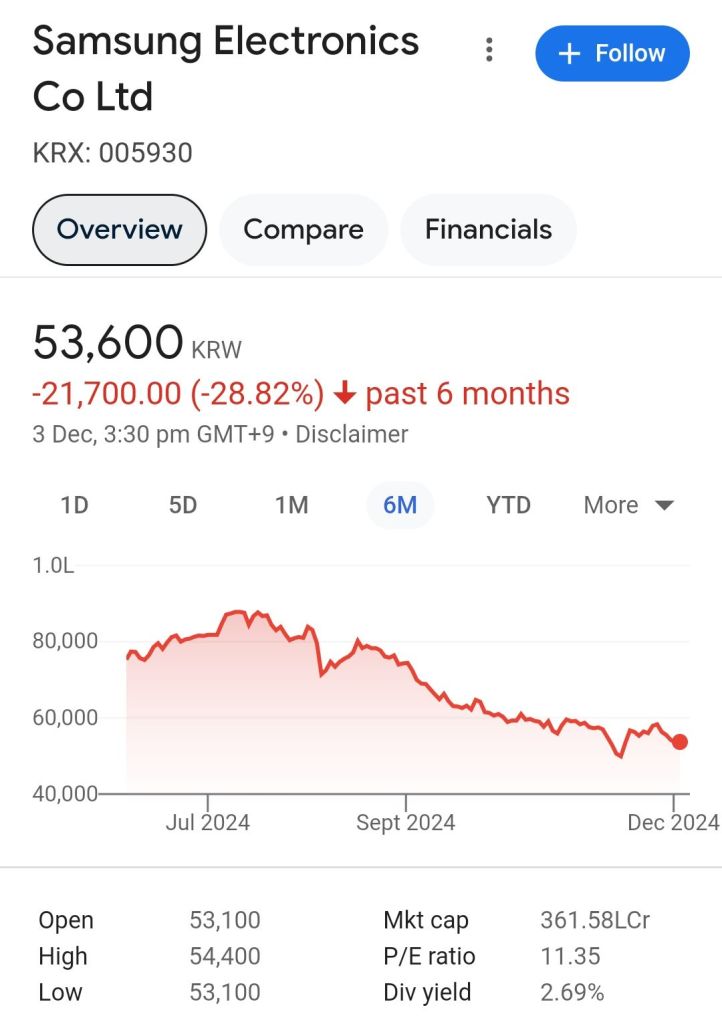

Considering the performance of the above large cap companies of Korea, it is very clear that the economic situation has constantly deteriorated. Now when things become out of control,the political turmoil starts with different excuses.

The real beneficiary under the current scenario is no one under the present situation because companies like Samsung which holds the largest share have global presence and the other companies are also well diversified despite the fact that the origination is from Korea. But on the other hand any investigation starts against Samsung like in the previous past then outflow from one single stock can create chaos in the whole KOSPI market because of the over dependency of one stock.

In between the only motive of Korean central banks will be to provide ample liquidity to the Market against all odds and support Bonds and Share market through ban on short selling.

If any benefit through rebalancing of MSCI index happens then it will be China to attract this miniscule flow of money and absorb quickly.India already battling with GDP issues and slowdown issues cannot make its Bonds and market as attractive.China though battling with severe slowdown has already made base rate attractive for recovery.

But the smart position and money managers had already anticipated this position much earlier. Therefore, large corporates in conjunction with big foreign institutions could have already safeguarded themselves against all odds.

Conclusion

The real losers are the citizens who trusted the system which betrayed them at the cost of vested political interest.

No matter how much we talk about transformation globally but the real fact still remains the same that 20% people control 80% money i.eThe Pareto Principle. Today no country is safe from political and geopolitical risk as growth is limited while the risk to growth is rising. In such scenario deflecting blame on other events is a simple choice politicians are willing to take. The cost unfortunately falls on the masses who will have to unburden the whole system again while seeing deteriorating living conditions. Fact of the matter is South Korea has a highly declining population coupled with low growth options. That is going to soon affect its currency. And the Korean economy is a bell weather for the global economy too. Investors better be prepared for what’s coming.

From CA Nishant Maheshwari and Vishal Vora

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Number: 00000037522669317

Account Holder Name: Rashi Maheshwari

IFSC:SBIN0005222

Name of Bank: State Bank of India, Sector 62, Noida

Note: The views published here are of the authors and should not be construed as a financial advice. Investors are requested to consult their own financial advisors before taking any action on such views.