Corona Virus was the pin that pricked the bubble. The system needed liquidity to restore the confidence from slowing economy. The bazooka of liquidity that followed boosted the GDP numbers with record debt levels even in the most powerful First world country like “The USA”. The Fed played its role in printing money out of thin air while the Government fulfilled its role to keep citizens smiling through Direct benefit Transfers. The chart below tells us the real picture of Government Debt position of USA.

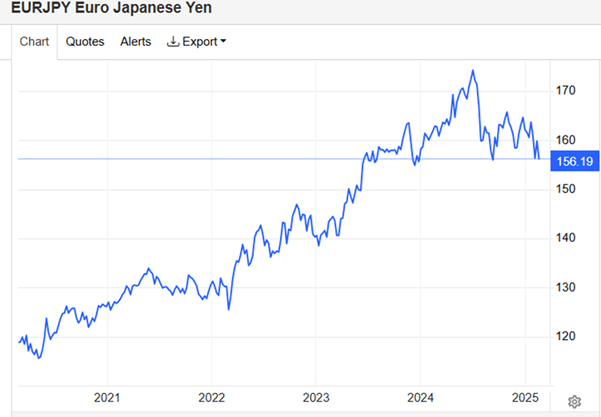

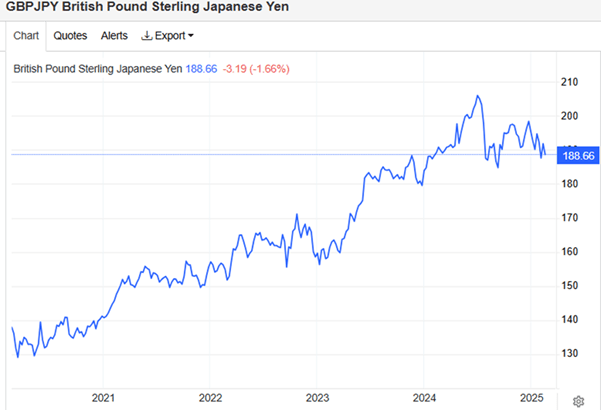

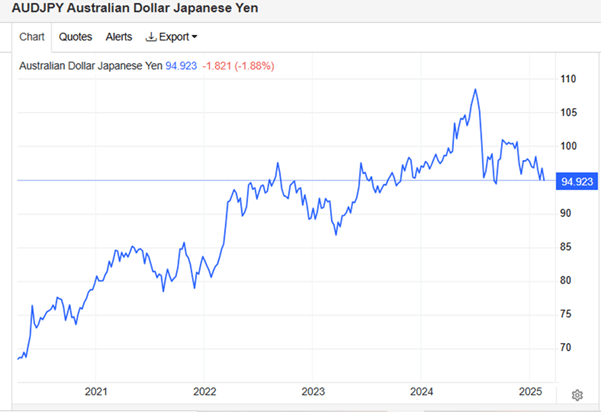

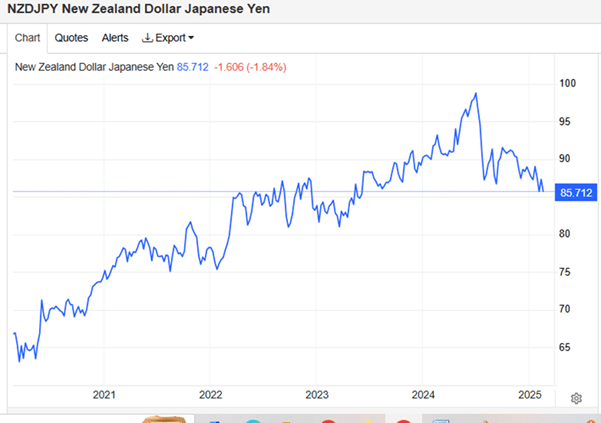

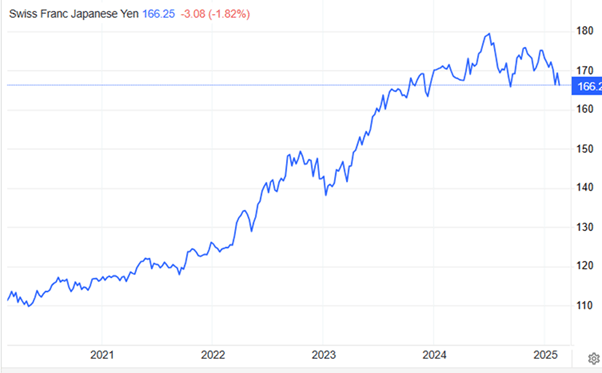

When the Fed started tapering its balance sheet, the next liquidity provider entered into the game with the intention to boost its economy after fighting for almost 40 years. Japan took the batton from US and let its currency in a free fall which we already explained in our carry trade blog whose reference is https://thefellowinvestor.in/2024/08/04/global-markets-an-update-on-current-situation/ . The chart of Japanese Yen shows the liquidity drive of Japan to keep the market alive and cross its 40 years high and end the period of stagnation.

on the other side China faced economic trouble which allowed global market to cheer the momentum of liquidity due to rise in asset prices. The MSCI weightage of China started shrinking constantly and helped the rest of the world specially Asian countries like India, Veitnam, Indonesia etc to cheer the surplus liquidity as their stock markets and investments rose.

The source of surplus liquidity parked through reverse repo via Japanese Yen route made investors overconfident that this route is permanent and became a fixed Income source.

Buffer of this surplus liquidity of Japan provided got parked in Reverse repo which helped the Stock market to zoom globally ignoring the threat of shrinking balance sheet of Fed on global liquidity. The liquidity was parked in long duration Bond products causing a serious trouble in short duration products. This resulted in inverted yield structure for a prolonged duration than the normal one historically.

The selling in long duration Bonds like short duration bonds started causing immediate need of money which was fulfilled through long duration bonds. But when the same yields un inverted then immediate needs of short duration money was fulfilled through reverse repo money which is now used as emergency window for Bail out. This all resulted dollar Index inversely correlated with Japanese Yen. Higher the Dxy index higher the depreciation in Yen.

The world is divorced with parallel ground of Inflation wherein the two largest economies were fighting with two different reasons. At one end it was inflation fight in USA and on the other end it was deflation fight in China. Last decade it was polar opposite. The third one was end stage of fight against deflation while welcoming Inflation. That is Japan.

So today we will discuss about drying global liquidity from Japan and the upcoming Debt crisis of Japan resulting in margin calls globally.

Japan is sleepwalking into a Soveriegn Debt crisis. This economic predicament is the result of last 35 years financial engineering designed to sustain a system that should have collapsed long back in 1990s era. According to Article 4 of Japan’s Fiscal Law, it is necessary for the Government to issue 2% of GDP in Japanese Bonds every year for defense policy projects until the Government is satisfied.

In recent past, Japanese Corporates have sold 14.7 trillion Yen ($96.8 Billion) of local currency Bonds in anticipation of series of rate hikes in order to avoid any increase in future borrowing cost. The issuance surge underscores the sweeping changes taking place in Japan.

After the implosion bubble in 1989-1990, Japan went into multiyear long deep crisis mode resulting in stagnation, deflation and weak GDP growth. The Index Nikkei collapsed by more December 39000 in 1989 to 7416 in 2008 resulting in 81% crash (80.98% in absolute value).

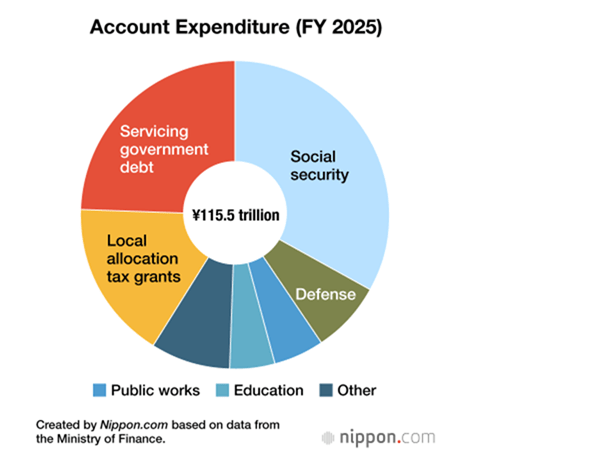

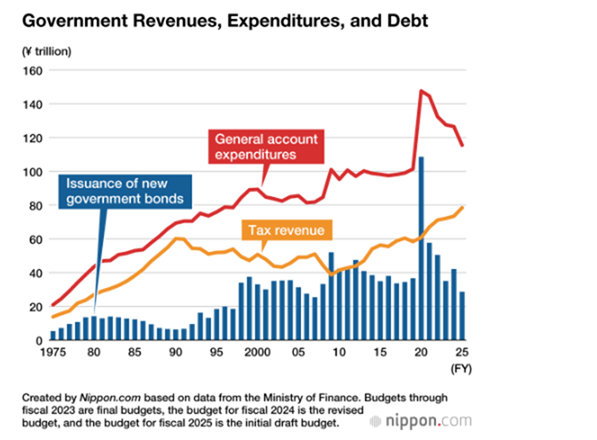

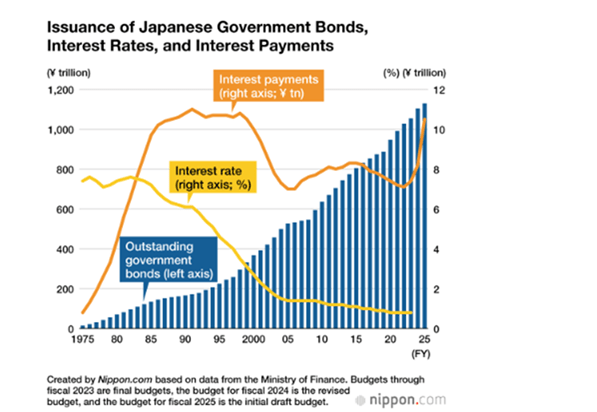

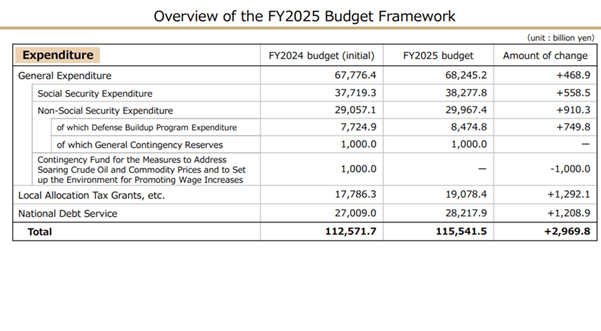

Since 2012 the Bank of Japan went into massive buying spree resulting in accumulation of 760 Trillion yen Assets with more equivalent liability. Thanks to funny money Japanese Central Banks printer were constantly running day and night to print Yen which resulted in Yield curve control. The end result as on date is horrific wherein the estimated holding of Bank of Japan is more than 50% of Government Bonds (Without claiming Central bank’s Intervention). The low trading and negligible volume dried the demand of foreign investors and resulted in fear of central Banks policy. This artificial structure ultimately suppressed the interest rates for a prolonged period of time. The recent inflation kick has resulted in rising yield and yields has touched the level of 2008 Financial crisis. The Japanese Government presently owes 8.00 trillion dollar debt and every .10% increase can cause additional payment of billions of dollar burden. As per “Overview of FY 2025 Budget Framework” some the interesting charts are as under:

As the above chart explains, the issuance of govt bonds and liquidity has helped to keep Japan a weaker currency while also leading to higher growth but a higher increase in expenditures as well.

The above chart shows the relentless rise in govt bonds and suppression of interest rates that has helped fuel the economy. Also highlighted is the fact that in spite of falling interest rates the interest payments are still rising.

is interesting to see that 24.44% of budgeted expenditure is spent on service of Debt while the interest charts are still at bottom of the cycle. Imagine the kind of situation when interest rates hikes are in series. Remember that the interest rates went down from 7-8% to negative interest rates. Now it is 1.42% in 2025 (As on date of writing of blog).

It is quite evident that Japan’s economy runs the risk of facing the same problems it did in 1988. To keep liquidity flowing it will have to continue printing which will pressure currency and rates too all at the same time making the debt position bigger and reaching a financial end game where in the underlying currency bears the brunt of a failed monetary experiment. Japan is going to teach the world lessons in fiscal management.

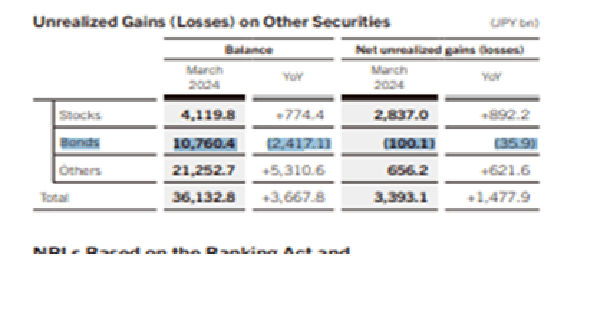

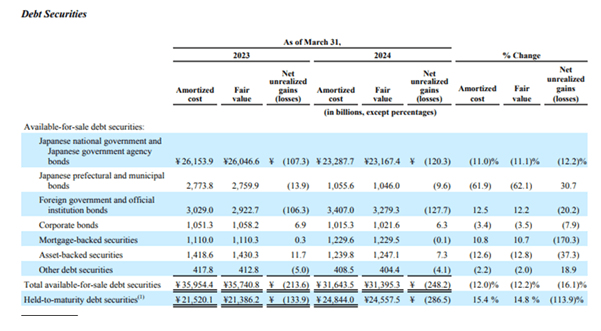

The only action happening right now is carry trades which is global liquidity provider for world markets. But when it comes to unrealized losses on Bonds and countries sovereignty, the interest cycle can expose vulnerability through Mark to Market losses of Banks. Here’s the position of Japanese Banks sitting with mark to market losses as on 31.03.2024 are as under:

1.Sumitomo Mitsui Banking Corporation

2.MUFG Bank

3.Mizuho Bank

4.Resona Bank

Conclusion:

In a world driven by liquidity it is the supply that matters. As long as supply is intact markets will live for another day. But even a small disturbance can bring central banks back to money printing and increase money supply as is evident in China and now Japan. The confluence of rising inflation, interest rates and increased money supply forces central banks to get trapped as they can’t raise rates nor can they keep printing. Japan is the only one managing this delicate balance and to some extent the Europe. Any negative step can cause outsized reactions in global markets and raise volatility again causing a repeat of history. That Japan is likely to print is a known fact but given the fiscal position it is in the fiscal road is shortening at a rapid pace and it will be difficult in the long run to escape the day of reckoning. The end result will be a rapid decline in its currency and purchasing power.

Reference:

The users can read our previous bog on Japan too

Besides this the people can read about Norinchukin Bank

- By Nishant Maheshwari and Vishal Vora

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Number: 00000037522669317

IFSC Code: SBIN0030115

YN Road Branch, Indore,India in the name of Rashi Maheshwari