Part – I

The world is going through a global economic crisis which is historic in nature. While the Covid-19 pandemic has certainly played a major role, it is by no means the only reason. It is our understanding that the economic crisis was in the making prior to the pandemic, as unrestricted credit growth and debt fueled speculation stretching valuations to the extreme and leverage to the maximum.

This article is a part of a series of articles explaining the history of the current crisis from the time of the Great Financial Crisis and how it is going to impact us in future. By the time this is published, a lot of digital ink would have been spent on how much money investors have lost in the past few weeks. The purpose of this article is to explore how the fall is the part of a process created through years of complacency and investor optimism forged by central bank stimulus measures that are the pillars of the current bubble.

The Investor Psychology

Trust and confidence are the cornerstones of the banking and financial industry. It is this trust and confidence which investors and the common man on the street display when they go about their economic activities. When the great financial crisis happened in 2008, this trust and confidence was broken and could only be repaired through constant intervention in the financial markets. From 2009 to 2014, the FED announced number of steps to stimulate the economy ranging from TARP to Quantitative Easing 1,2,3. Every time the market looked wobbly and fragile, central banks came to support the markets. In 2015, when the Chinese devalued their currency, the markets froze and only resumed normalcy once the FED decided to delay rate hike. When the market became wobbly again in 2016, major Central banks coordinated their moves to support the market. This helped ease the volatility and increased investor confidence. When US President, Donald Trump got elected and Brexit happened in 2016, investors were again worried about the risk to the financial markets. But substantial tax cuts and liquidity in the markets ensured that investors would continue to chase the financial assets. Even though FED did hike and Donald Trump did start a tariff war, investors were not worried because liquidity was ample and markets well supported. Investors were able to negotiate through volatile markets in 2018 and 2019 with the FED cutting rates and starting repo operations. It was like a toddler running his bicycle knowing fully well he would not be allowed to fall as the parent would always provide necessary support just in case.

At every point, investors were given a fake sense of confidence through stimulus measures such as rate cuts, quantitative easing, bond buying, asset reconstruction, repo operations and relief programs. On the other hand, stock markets became a great wealth creating machine turning millions into billions. Investors had everything going for them. They were making hay while the Sun was shining, occasional problems notwithstanding.

Chinks in Central Banks Armor

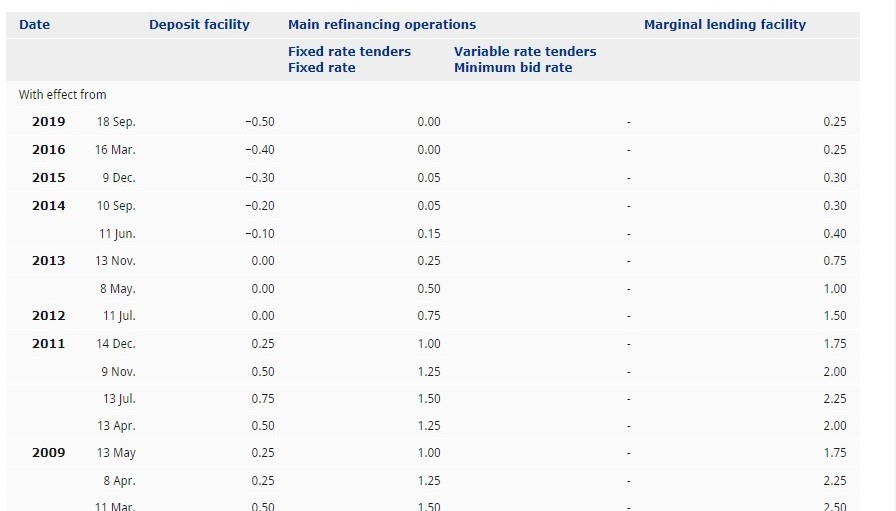

But deep down, problems were increasing and complications were rising. Japan and Euro region had never been able to raise rates to pre-crisis levels and they even experimented with negative rates which is now affecting banks’ profitability.

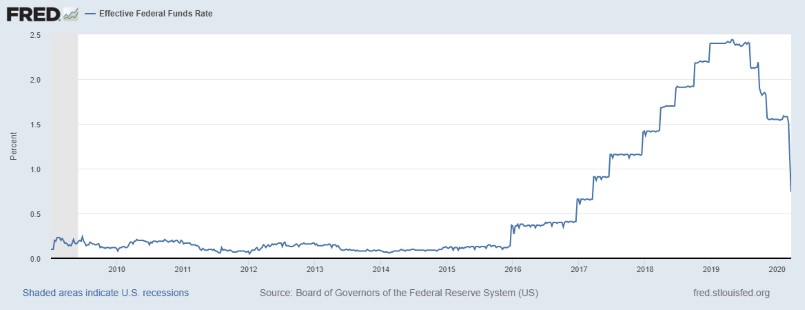

Source: ECB, St. Louis, FED.

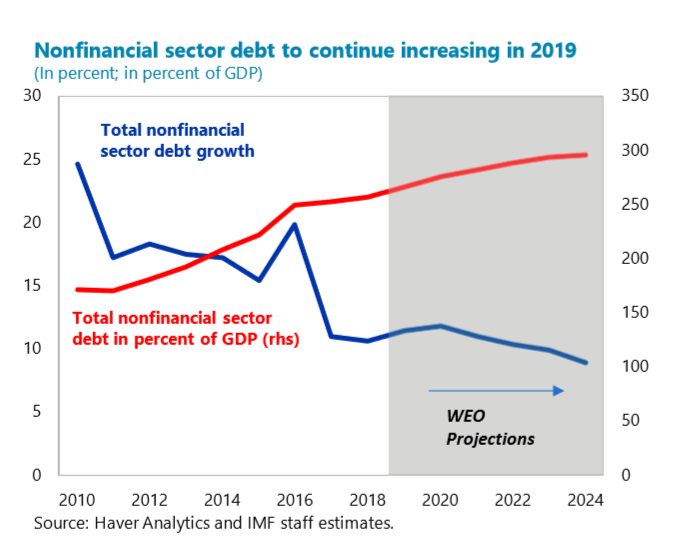

Japan has bought every asset they could bonds, ETFs, stocks etc. The ECB has done whatever it could. The FED is getting into a corner having just cut rates to zero and issuing massive $700 billion worth of quantitative easing programs along with repo operations and dollar swap lines. But even the FED couldn’t raise rates to the levels of pre-crisis and it is hurting. Before the last financial crisis in 2008, interest rates were at 5.25% which they took down to zero in fighting recession. Similar space is not available today. The Chinese on the other hand have been the only source of global reflation. They have been the biggest consumer of raw materials and biggest manufacturing hub. Not to mention, they even had a real estate boom. The rich Chinese people have been buying real estate throughout the world as means of diversifying and reducing country risk. But all this growth has been supported by debt and the Chinese figures are now near 300% Debt to GDP ratio. It may be fair to say they have been on a debt binge unprecedented in history.

Source: IMF Country report, 2019, China

Problems in the Global Economy

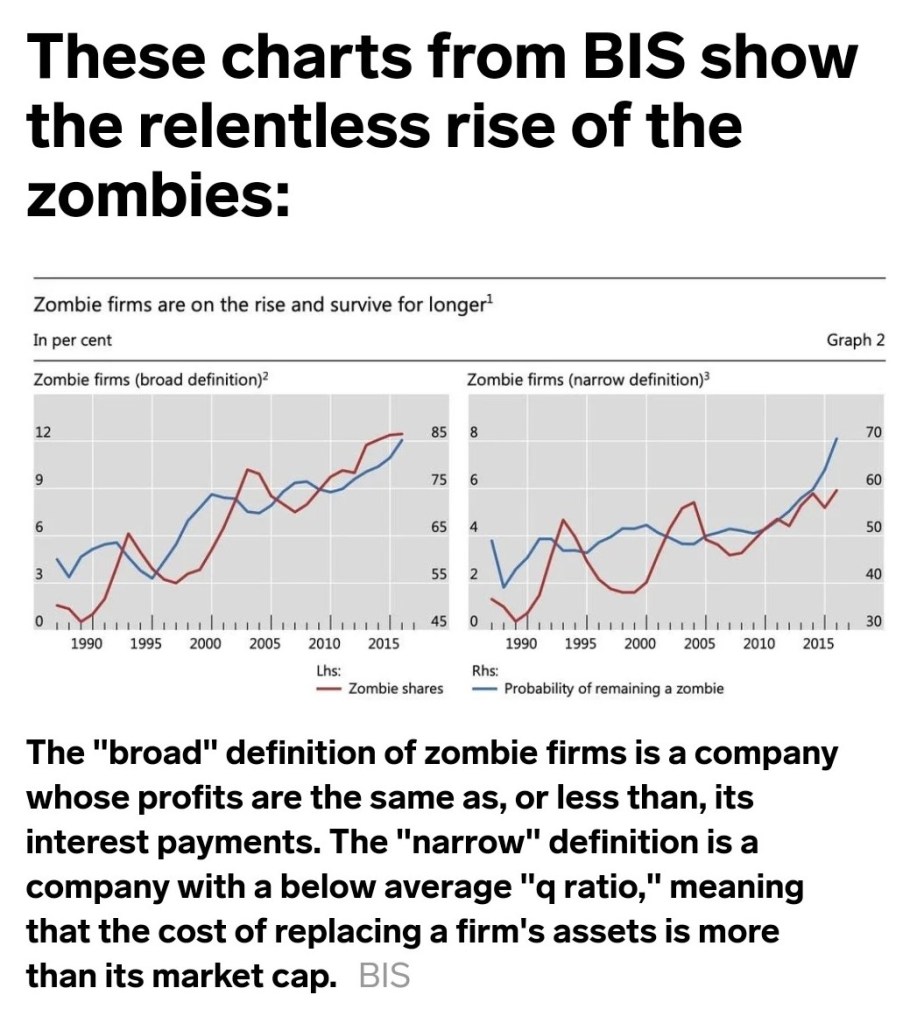

While all this was happening in the financial markets, there has a been substantial lack of demand for labor and fall in real wages. Consumer price inflation though benign hasn’t accurately captured the increasing cost of living. A decade ago, the cost of healthcare, housing and education were affordable to the common man. However, the past decade has seen an unprecedented rise in the cost of all essential services and goods. Today, consumer debt is at an all-time high in most countries. So are education loans and mortgage loans. Healthcare is way more expensive. It is now difficult for a vast majority of the population to meet these expenses without going into debt. The rising cost of living has made it impossible for people to retire early leaving less job opportunities for young people. Automation and machine learning are other factors leading to job losses and reduction in available jobs in the market. Most of the jobs are now service jobs with low pay. The sharing economy has also impacted margins and disrupted business models. Zombie corporations are increasing leading to increase in corporate debt. Leverage in the system is growing unrestricted.

Source: Business Insider, BIS

Given the anemic growth in real economy, poor financial health and demography of the consumer, debt burden on the economy, the only way to create growth has been to pull demand forward by borrowing from the future. Central banks have been forced to cut rates at record levels to manage their interest payments while enabling zombie corporations to survive by delaying their day of reckoning (number of zombie corporations are now in double digits). There are hardly any developed countries left having fund rate above 1% indicating lack of strong growth.

The above things have highlighted how the real economy has been left to suffer the side effects of the financial crisis while the financial side of the economy has been supported to make a small percentage of the population wealthy. It is safe to say that the financial markets have now become the economy. This imbalance in the real and financial assets are root cause of wealth inequality and our economic problems. The last decade has seen significant wealth transfer from masses to the elite class as those who control corporations and factors of production are extracting their pound of flesh through suppression of wages, monopolistic practices and increased prices of products. Governments around the world have masked the problem through indicating the wealth generated in financial markets as the barometer of progress.

In part 2, we highlight the problems that will be soon reverberating across the globe and how the giant bubble will collapse taking everything with it like a black hole.

#economy #economiccrisis #sensex #Investment #wiseinvestment #thefellowinvestor #bullandbear #stockmarket

- By Vishal Vora, Nishant Maheshwari

Disclaimer: The above article is based on views expressed by the authors and are meant for information purpose only. Readers are requested to take investment decisions by consulting your financial adviser.

Amazing analysis

LikeLike

Amazing one Vishal Bhai

LikeLike

Good insights. Thank you

LikeLike

Superb … Bro

LikeLike