Liquidity has been a robust tool to support various financial market post 1987 for Japan, Post GFC & Post COVID.

Pre Covid, global economies and their central banks were sailing in the same boat. If deflationary environment was visible then the whole world was experiencing the same phase because the bazooka of liquidity was constantly coming from same source (i.e. central banks co-ordinated moves) which provided economies to provide liquidity within their own system while the supreme power is attached to provide constant quantitative support since 2008 which can be used as exports proceeds or external commercial borrowings.

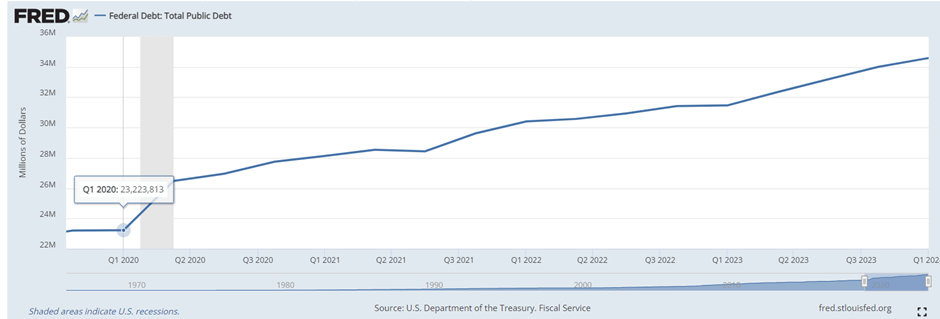

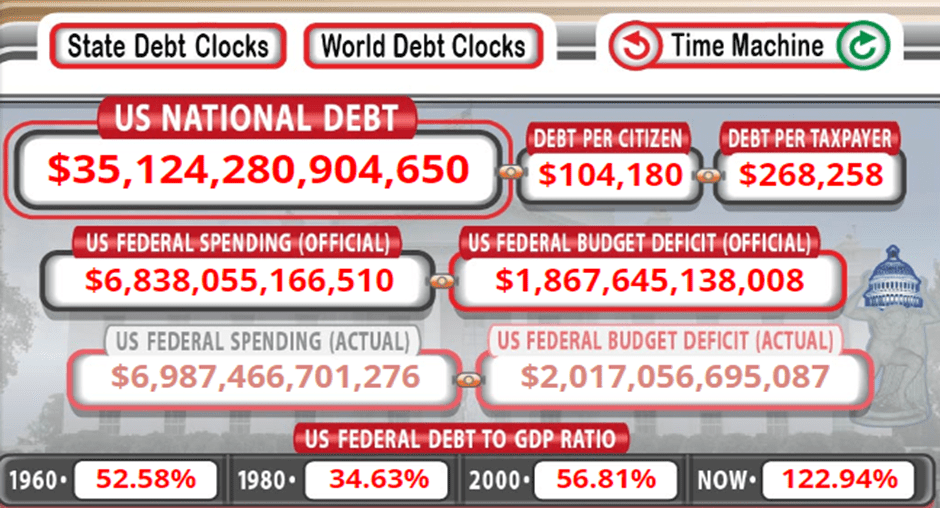

The data of US debt provides you various proofs that that how liquidity tools really helped till 2017 before the Fed did actual tapering which was rolled back again. The same really helped Equity markets and commodity markets to get pumped at its best and cause hidden inflationary spike into the system post.

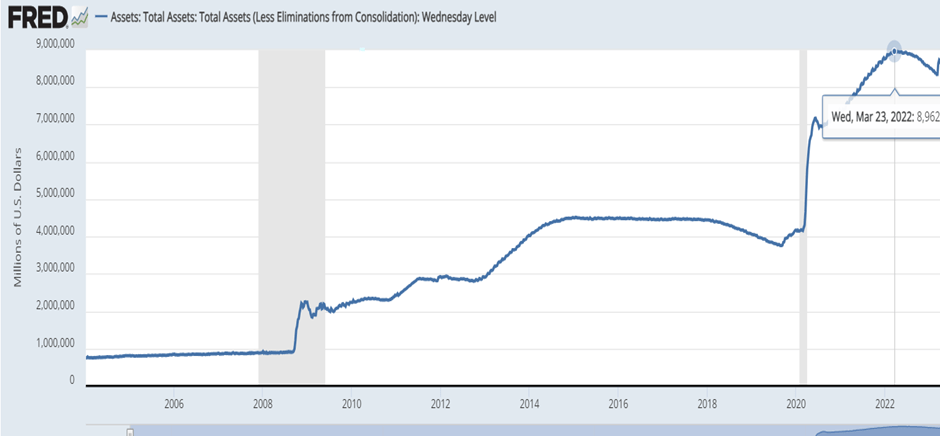

Source:Fred-Fed’s Total Assets

Though Macros usually get sidelined in Bull market but the importance of business cycles is always felt at the onset of bear market.

Our Blog is divided into three categories:

- Japan-Specific focus on carry trade & Inflation

- China-Specific focus on Deflationary environment

- USA-Focus on Fight against Covid and now Inflation

(A) Japan

In many respects, carry trades across the world are driven by BoJ policy. Carry trading involves borrowing money in a low-interest-rate environment and then investing that money in higher-yielding assets from other countries. With a stated policy of near-zero interest rates, Japan has long been a major source of capital for that trade. This also means, though, that ripples throughout the currency markets can be sent by talk of higher rates in Japan.

Source:Alt21.com

Summarised Version Japanese Economy post 1987 crisis

*A carry trade is a type of foreign exchange trade in which you borrow money in one currency at low interest and use it to make high-interest investments in another currency. As the name suggests, in a Japanese Yen carry trade, the currency you borrow in is the Yen

Post 2021 when Fed started Quantitative tightening in Books, Japan started providing Global liquidity to world. Japan holds 5% share in Global currency. While the country was inviting inflation, the Central banks of Japan was busy in Bond buying since last three decades. While the global traders were betting against the Japanese Bonds yields, the country started experiencing Inflation effect after the end of YCC. When the bonds yields inched higher in spite of all measures the currency of Japan started bleeding. It went up from 105 to 160 in less than 1 years time. Till that time addiction of Japanese central banks shifted from Bond buying to Currency Buying. They kept the bazooka of liquidity afloat without raising interest rates and constantly intervening billions of dollar in currency trade. When the funny money liquidity was provided free of cost by the country, the size of carry trade started increasing to more than $20 Trillion dollar “Carry Trade”. Off the same cannot happen without Japanese Government involvement and various Financial institutions of Japan.

Now post reversal of Yen from 160 to 146(courtesy Japan central bank raising interest rates), sudden margin calls popped up the safe trade and forced the shorters to wind up the position. This resulted in sudden spike of volatility in Global market resulting in wiping of trillions of dollars of market cap globally.For more information on 36 years bubble of Japan, refer our blog https://thefellowinvestor.in/2023/01/18/bank-of-japan-self-created-trap-of-36-years/

(B)USA

The role of Fed creates a global impact on various financial institutions and policies of Fed lay down the future of money supply into the system. Events post Corona are summarized in a Flow chart manner to determine the liquidity tool and its impact in Financial System.

SUMMARISATION OF ROLE OF FED

Corona in March 2020

Resultant Impact

(a) Bull whip Effect

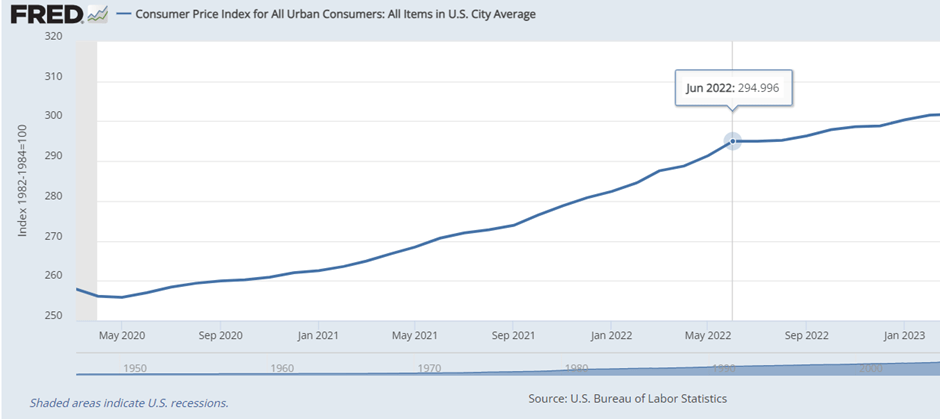

Source: Fred

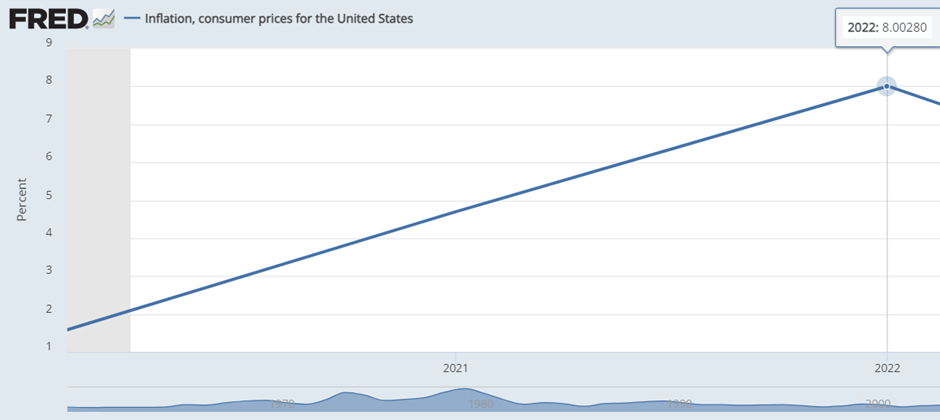

(b)Inflation

(c)Housing Market Euphoria

Refer: https://thefellowinvestor.in/2022/05/05/housing-market-bubble-2022/

(d)Increased Borrowings of Government

Refer: https://thefellowinvestor.in/2022/09/25/global-debt-crisis-can-this-time-be-different/

(e) Increased Credit Card Loans

(f) Increased Vehicle Loans

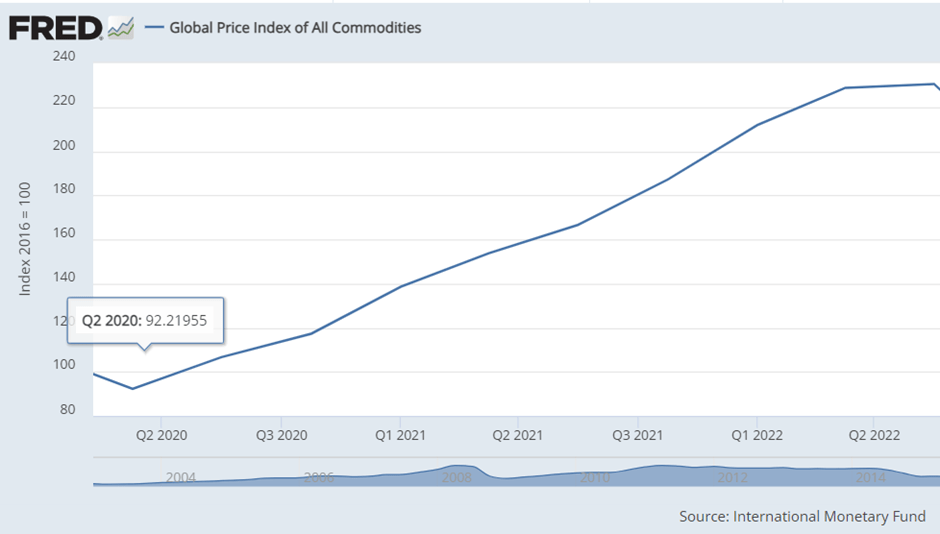

(g)Commodity boom

(h)Fed officially doing Quantitative Easing by Buying Bonds

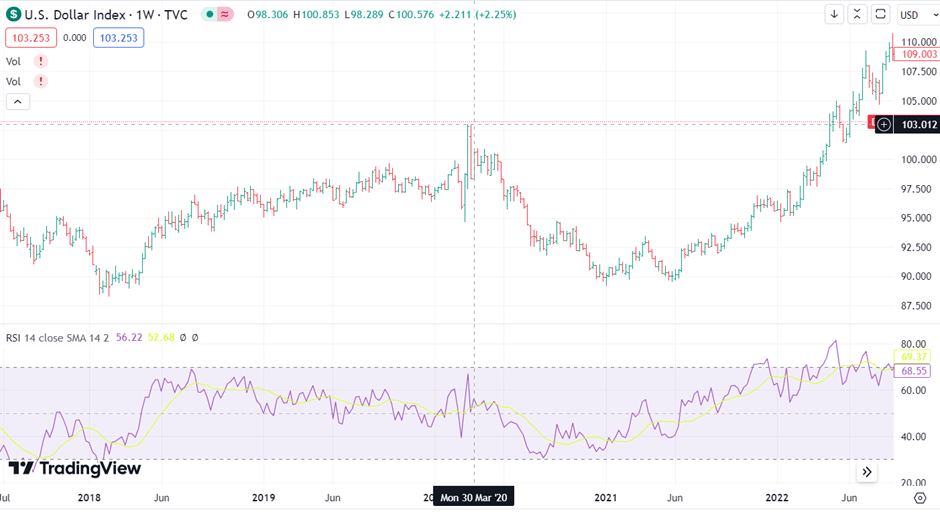

(i) Deterioration of Purchasing power due to lower Dollar Index

Source: Trading view-Dollar Index

On 30th March DXY went to 103 and till 2021 end it went to 87

Measures to Curb Inflation

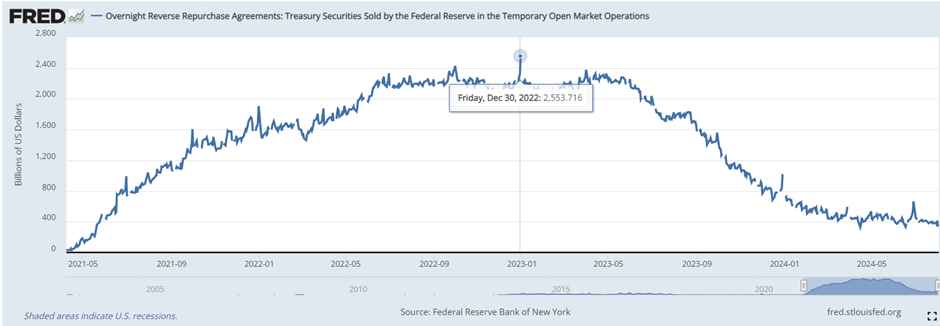

(a)Reverse Repo

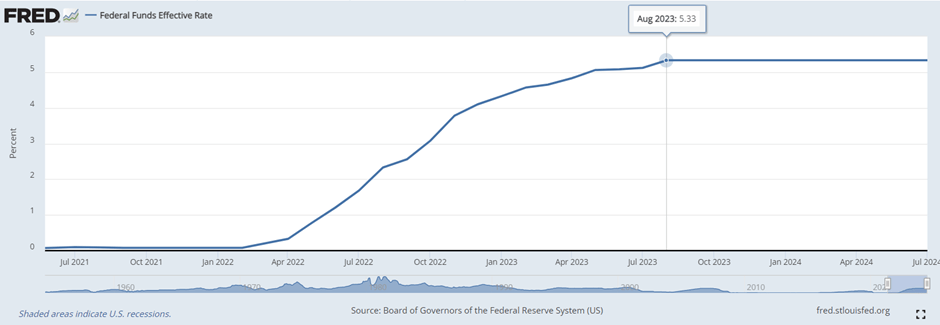

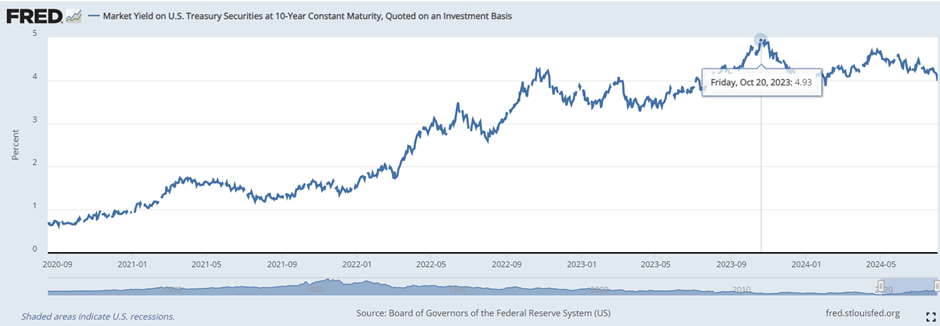

(b)Rate Hikes resulting in Bonds sell off

Increase from 0.08% in Feb 2022 to 5.33% resulting in 11 rate hikes.

US 10 year increased from 0.69% on 17th August 2020 to 4.94% in Aug 2023

(d)End of Loan moratorium period

Impact of measures taken by Fed

(a)Corporate Bankruptcies

A faster pace of bankruptcy filings has been opted for by Americans as their debts cannot be repaid by them. By a few major banks, it was announced that losses exceeding $4.1 billion were experienced last quarter due to debts that remained unpaid. A 15% rise in bankruptcy filings in the US has been recorded in the first half of 2024, with the total number reaching 217,000. Spending has been reduced by consumers and the turning of a profit has become unachievable for businesses.

More details reveal that prolonged supply chain issues, inflation, higher interest rates, and decreased consumer spending have collectively contributed to an increase in business failures. Corporate bankruptcies reached a 13-year high last month, marking a significant strain on the economy. Notably, the most considerable uptick has been observed in Commercial Chapter 11 filings, with an alarming 43% annual spike recorded from Q1 of 2023 to 2024. A general increase of 22% in commercial bankruptcies was observed in Q1 of 2024, indicating that 7,113 businesses went under compared to 5,820 in Q1 of 2023.

The first half of 2024 has recorded 346 corporate bankruptcy filings, marking the highest number in over a decade. In June 2024 alone, around 75 corporations filed for bankruptcy, reverting to levels seen during the pandemic when businesses were forced to close due to lockdowns. A significant acceleration in pace from the initial months of 2024 was noted, a trend rivaled only by the busiest months of 2020, a period during which the shock from COVID-19 pushed a relatively higher number of companies into bankruptcy, as proclaimed by S&P Global Market Intelligence.

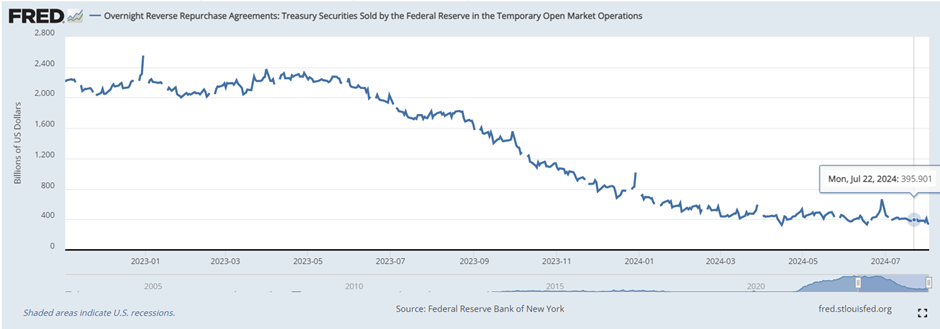

(b)Reduction in Reverse Repo

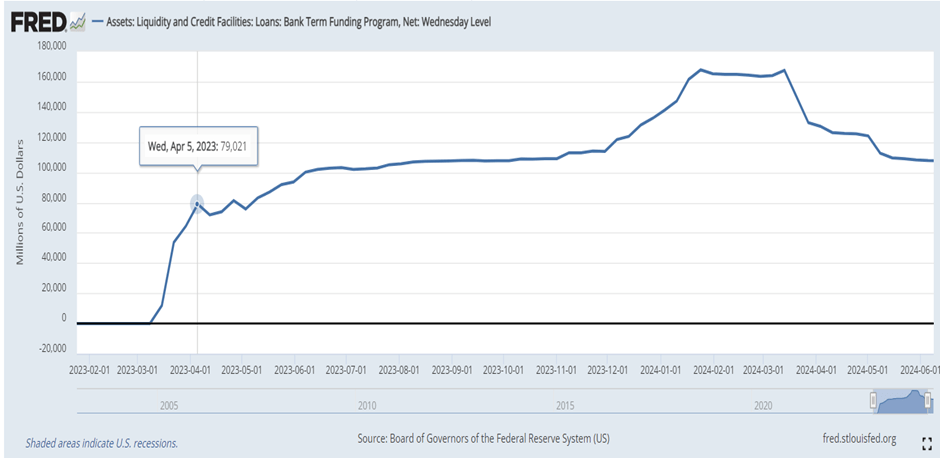

(c)Starting of Emergency Window to provide liquidity to GSIB Banks to take over Regional Banks

Source:Fred- Loans: Bank Term Funding Program

(c)Providing Liquidity to other Regional Banks and cross border liquidity

(d)Commercial Real Estate Crisis

Refer:https://thefellowinvestor.in/2023/06/13/debt-threat-from-us-reits-the-next-bubble-in-us-market/

In this entire scenario, it is interesting to see how one factor (liquidity) since starting of Corona till date has always played with historical macro concepts where in it was observed that recession was confirmed when yield curve inverted yet today as more than 700 days have gone this inversion still continues. This is the longest inversion since 1929. Similarly, when DXY showed spikes, the market usually gets hammered but post corona DXY started upward move and maintained to close above 102 which is more than the level of black swan event experienced during 2020.

New bubbles in stocks like TSLA, NVDA, Meta, Microsoft etc got created while short squeeze in stocks like GME, AMC etc became usual habits. In between pumping of surplus liquidity created product bubbles like NFT or unwanted speculation in Crypto.

Market always looked at short squeeze on every moment and euphoric move continued till date.

When the inflation was facing turbulence jerks on account of liquidation of bonds, the war situation globally started in the form of verbal statements.

When the verbal words got ugly, real war started between Russia and Ukraine which again gave boost to inflation and prices of commodity like Electricity, Natural Gas, Wheat, Crude etc saw sharp surge.

Liquidity was tapered only in Books while Emergency programme kept the bubble alive and insane valuation on account of falling volume and high PE became new normal.

Frequent bubble rotation in the name of EV, Climate change, AI etc happened.

Post corona, the debt of US increased from $23.22 Trillion dollar to almost $35 trillion. Withing a span of 4 years, US added debt of almost $12 trillion

Source: USdebtclock.org

US used pay check programmes to support its citizen facing challenges during Corona. While on the other end zero interest rates era supported people to enter into residential as well commercial real estate. The spending of people abnormally increased causing bullwhip effect into the system in the initial years.

The resultant increasing debt in US caused inflation and the ultimate effect has been passed to Banks where crisis occurred in Regional Banks due to loss on bonds that they had accumulated.

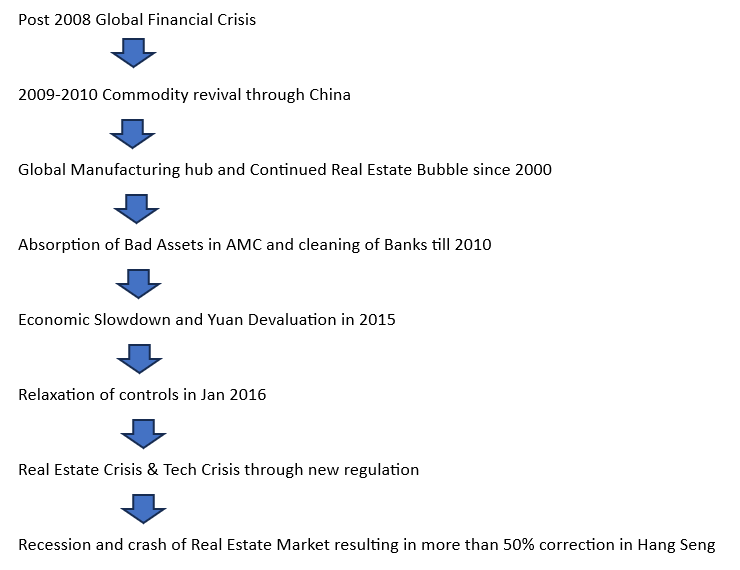

(C) China

Before 2008, had it been same thing in case of China (Worlds largest manufacturing hub) could have given real cushion over 1997 Asian Currency crisis moment. But never the less, at present Chinese GDP is 30% directly dependent on Real Estate so that also involves lots of foreign dollar absorption into the economy which was creating notional increase in value of assets to give benefit to Yuan. But in reality, it’s a wealth disparity gap wherein the investment in real estate has reduced velocity of money. More than 74% of household wealth is into real estate. So whatever investment went in real estate in later years has become sunk cost for the country unless and until real demand and supply comes into picture.

Post real estate crisis, Chinese central banks provided the bazooka of liquidity to support economy in anticipation of recovery in Real Estate market and in house consumption. Rate cuts and constant repo cuts have provided ample of liquidity to China but yet the situation remained as it is. The in-house consumption within China post real estate bubble is constantly shrinking. The country is constantly fighting deflation over the period of two years but unable to take advantage of liquidity. In 2008 Chinese created hopes to provide global liquidity by lifting the commodity prices single handedly. However, when the real estate bubble became too big and got propped, China was and is still unable to fight deflation.

For more reference on what happened with China

Refer:

https://thefellowinvestor.in/2021/09/10/global-event-update-evergrande/https://thefellowinvestor.in/2021/09/15/global-update-evergrande-part-2/

Conclusion

Globally, every individual is currently living in a fantasy of the liquidity pool created by central banks. They(central banks) could manage this as their end goals were common to fight deflation. However, with geopolitics taking an ugly turn coupled with increasing amount of liquidity required to support the current system followed by failure of experimental monetary policy and tight fiscal policy, central banks have now been left to fend for themselves. Therefore the pool of liquidity is currently unstable and volatility should now be order of the day. Investors have tasted risk free returns in risk less markets created by central banks. They are about to get a lesson in ‘ When the tide goes out, everyone knows who is swimming naked’ regime. Volatility is about to rise and investors are going to get introduced to risk. The tide will go out and come back with even more vengeance creating a tsunami of liquidity which will create a further big oscillation in market liquidity and inflation thereby creating a big jump in yields. What happens after this is anybody’s guess but protecting oneself from this onslaught is going to be difficult if not impossible. Central banks have your fate attached to their decisions. That such a situation could ever arise was an improbable event a decade earlier. Yet here we are and this is an event turn that is expected to decide our future. Brace for increased volatility.

From CA Nishant Maheshwari and Vishal Vora

In case you are interested in making a contribution to our writing, please do so in the following account:

Account Number: 00000037522669317

Account Holder Name: Rashi Maheshwari

IFSC:SBIN0005222

Name of Bank: State Bank of India, Sector 62, Noida

One thought on “Global Markets – An update on current situation”